9 Important Accounting Concepts [Notes with PDF]

In this post, we will learn in-depth about the accounting concepts including their definition, 9 important concepts, and much more.

What are Accounting Concepts?

Accounting concepts are fundamental ideas that are used in the accounting process to achieve accounting objectives.

These concepts are internationally recognized, universally accepted, and their self-evident rules assist in the execution of all accounting activities.

Accounting concepts are the fundamental assumptions and conditions that serve as the foundation for accounting.

These concepts are logical, so it’s easy to figure out why they’re used and how to get a complete accounting explanation.

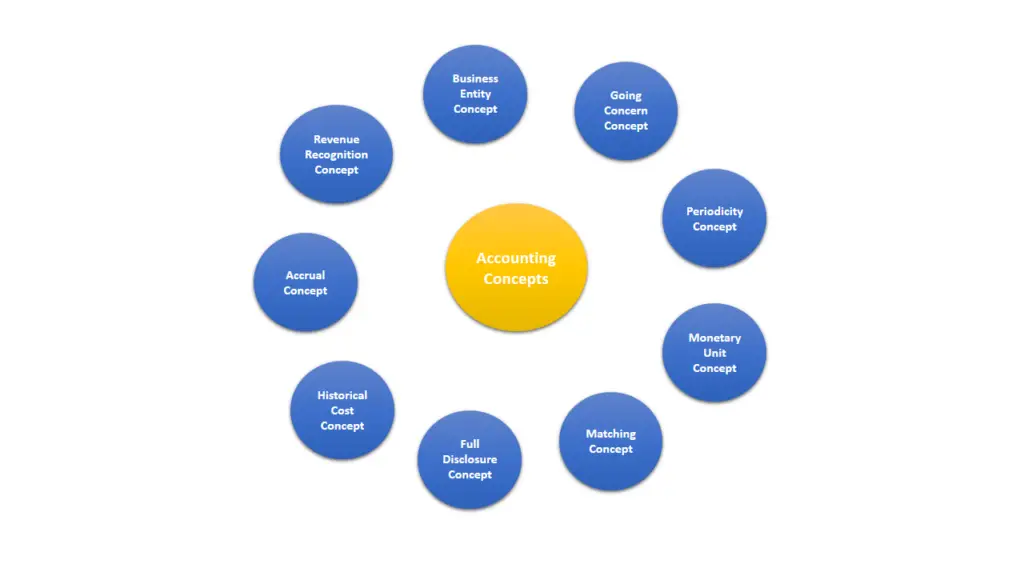

What are the 9 Important Accounting Concepts?

The 9 important accounting concepts are as follows:

Business Entity Concept:

According to this concept, the business entity is considered a separate entity from its owner. That is to say, the business and its owner are two distinct entities.

Only, for this reason, the business keeps all accounts in the name of the business, not in the names of the owners.

According to this concept, the income and expenditures of the owners are distinct from the income and expenditures of the organization.

According to this concept, the business can own assets and take responsibility. Business considers the owner of this business as a creditor and the money supplied by the owners’ shows as capital. Capital creates both the assets and liabilities of the business.

Although this concept has no legal basis in sole proprietorship and partnership business other than joint venture business, it is a universally accepted accounting rule. Otherwise, it is impossible to know the true profit and loss picture of the business

The Business entity concept is very necessary for keeping accurate accounts of the business and for determining the correct profit and loss.

For example, if the owner buys a product with money from the business for personal needs, that purchase cannot be considered a business purchase. It will be considered as an owner withdrawn from the business.

If the business records this cost as the cost of the business, then it will misguide the actual profit and loss of the business.

Therefore, the business is considered as a separate entity and from this point of view, the business records the transaction by analyzing the nature of the transaction.

Going Concern Concept:

According to the going concern concept of accounting, all the organizations except some fixed-term organizations will continue indefinitely.

That means the organizations will continue to operate year after year and has no plans to close the business in the future.

Due to this policy, income and expenditure are divided into categories i.e. capital nature and revenue nature.

Businesses prepare the statement of financial position by the capital expenditures and incomes and prepare income statement by the revenue expenditures and incomes

According to this concept, organizations charge depreciation on fixed assets till their lifetime.

Without this policy, it would not be possible to prepare a statement of financial position and there would be no need for charging depreciation.

Periodicity Concept:

According to the going concern concept, the business will continue for a long time i.e. there is no specific period of the business.

But the owner can’t wait for an unlimited period to know the financial status of the business.

Because the owner wants to know the profit-loss and financial condition of the business organization for a certain period of time.

That is why it is assumed that the organization will last indefinitely, but in practice, this eternal life is divided into short periods of time to determine the profit, loss and financial condition of each period.

This concept of accounting is called the periodicity concept. This accounting period can be one year or six months.

The accounting period for most businesses is one year. For example, a fiscal year starts from January 1st to December 31st, a fiscal year starts from April 1st to March 31st of the following year, and a fiscal year starts from July 1st to June 30th of the following year, etc.

At the end of each accounting period, businesses prepare a comprehensive income statement and statement of financial position to know the income-expenditure and assets and liabilities of the organization.

As a result, businesses can compare the financial results and conditions of one accounting period to those of another.

Monetary Unit Concept:

Businesses will only record those transactions which for measurable in terms of money. And this is the monetary unit concept of accounting.

According to this concept, Businesses will only record the transactions in the accounts book which are measurable in terms of money.

For example, goods purchased for $5,000, paid electricity bills of $300, goods sold for $6,000 on credit, etc. Here each transaction is measurable in terms of money.

If these transactions don’t have monetary value, they have no place in accounting. For example, appointed a manager in a business. It is not a transaction because it is not measurable in terms of money.

So far there is no single standard other than money. So money is the only standard for measuring transactions.

Matching Concept:

Each business organization prepares comprehensive income statements after a certain period of time i.e. at the end of an accounting period to know the financial results.

And Businesses create these Comprehensive income statements by applying the matching concept.

According to this concept, the business organization determines the profit or loss by deducting all the revenue expenses from the revenue earned within a certain period.

As a result, according to this concept, if any income for the next financial year is received in the current year, it cannot be considered as the current year’s income.

On the other hand, even if any income earned in the current year is not available in cash, it should be considered as the current year’s income.

Similarly, if current revenue expenditure includes future business expenses, it will not be treated as current accounting expenses.

On the other hand, revenue expenses that were payable but not paid in the current accounting year will also be treated as expenses in the current accounting period.

Overall, the basic idea of the matching concept is that in order to make a profit for a certain period of time the profit has to be determined by adjusting the income and expenditure received and paid at that time.

Full Disclosure Concept:

According to this concept, the financial statements should include accurate and reliable information about the organization.

Businesses should disclose all significant information that may affect the financial results and financial in financial statements so that users of the financial statements can make decisions based on the organization’s condition.

According to the business entity concept, we know that there is no direct relationship between the owner and the management of the company.

To that end, a full disclosure policy is implemented to protect the needs and interests of owners, investors, creditors, and employees.

Historical Cost Concept:

According to this concept, the company reports fixed assets in its financial statements based on their historical cost rather than their market value. In this context, historical cost refers to the asset’s purchase price.

Businesses keep track of transactions based on the purchase price.

For example, suppose a company spends $40,000 on a machine. The machine’s purchase price is $40,000, and the company will record this amount in the accounts book regardless of whether the machine’s market price rises or falls.

The market value fluctuates, and if the company records the transaction at the market price, the account’s acceptability will suffer.

According to the going concern concept, we know that the business will continue to operate indefinitely, so the organization does not purchase assets for sale.

As a result, the company records transactions at the purchase price rather than the market value. The historical cost concept improves the accounting’s reliability.

Accrual Concept:

This concept is the opposite of the cash concept. In the concept of cash, businesses record only cash transactions. In the case of the accrual concept, businesses record both cash and credit transactions.

According to this concept, when preparing a statement of comprehensive income, outstanding expenses are added to corresponding expenses that have already been paid, and outstanding incomes are added to related incomes that have already been received during the accounting year.

On the other hand, unearned incomes and prepaid expenses are indicated as a deduction from the respective account head.

Revenue Recognition Concept:

Businesses decide whether income should be recorded as income based on this accounting concept.

According to this concept, the right to receive or collect money from the buyer or service receiver is created when the ownership of the product is transferred to the buyer or the service is completed, and then it is recorded as income.

For example, goods worth $3000 are sent to the buyer on the condition of “sale or return”. In this case, the ownership of the product has not been transferred to the buyer so it cannot be recorded as income.

On the other hand, the sale of goods on the credit of $2000, will be recorded as an income (Sales Revenue) because the ownership of the goods has transferred to buyers even though it was not received in cash.

Similarly outstanding investment interest, commission earned but not received, etc. should be recorded as income even though it was not received in cash.

By the end of the article, you should have a good understanding of nine key accounting concepts. Please feel free to leave a comment below if you have any questions about accounting concepts.

You can also read: