Debit and Credit-Definition, Examples, Differences, Rules, Problems & Solutions[Notes with PDF]

In this article, we will learn all about debit and credit in accounting. We will learn what debit and credit are, examples of debit and credit, differences between debit and credit, how to identify debit and credit, practical problems and solutions for identifying debit and credit, and much more.

So let’s get started.

What is Debit?

The term “debit” is derived from the Latin word “debitum.” It refers to what is due or owed. However, it has a specific meaning in accounting.

The word “debit” refers to an account’s left side. Debit is commonly abbreviated as “Dr.” As a result, the account in which transaction details are recorded on the left side is referred to as the debiting the account.

What is Credit?

The term “credit” is derived from the Latin word “credium.” It means ‘what can be trusted.’ However, it has a specific meaning.

The word “credit” refers to an account’s credit side. Credit is commonly abbreviated as “Cr.” As a result, the account in which transaction details are recorded on the right-hand side is referred to as the “crediting the account.”

The left-hand side of a ledger account is known as the debit (Dr.) side. The right-hand side of the account is known as the credit (Cr.) side.

L.C. Cooper

As is commonly assumed, debit and credit do not mean increase or decrease. Throughout the recording process, the words “debit” and “credit” are frequently used to describe where entries are made in accounts.

Examples of Debit and Credit

The steps for recording debits and credits in an account are illustrated below for transactions affecting ABC International’s Cash account.

Account Form

Cash A/C

| Debit | Credit |

| $20,000 | $9,000 |

| $5,000 | $6,000 |

| $3,000 | $5,000 |

| $3,500 | |

| $4,500 (Balance) |

You’ll see that we record cash increases as debits and cash decreases as credits in the account form.

For example, the $20,000 in cash received (in black) is debited from Cash, and the $9,000 in cash paid (in blue) is credited to Cash.

Differences between Debit and Credit

The following are the key differences between debit and credit.

| Sl. No. | Subject of Differences | Debit | Credit |

| 1. | Side | Debit represents the account’s left side. | Credit represents the account’s right side. |

| 2. | Abbreviation | Debit is abbreviated as “Dr.” | Credit is abbreviated as “Cr.” |

| 3. | Origin | The word “Debit” is derived from the Latin word “debitum.” | The word “Credit” is derived from the Latin word “credium.” |

| 4. | Benefit | Debit is the benefit recipient. | Credit is the benefits provider. |

| 5. | Assets | Increase in assets. | Decrease in assets. |

| 6. | Liabilities | Decrease in liabilities. | Increase in liabilities. |

| 7. | Owner’s Equity | Decrease in the owner’s equity. | Increase in the owner’s equity. |

| 8. | Income | A decrease in income | An increase in income. |

| 9. | Expenses | Increase in expenses. | Decrease in expenses. |

Rules for Identifying Debit and Credit

It is necessary to identify the two accounts involved in a transaction in order to identify which class they do indeed belong to.

Thereafter, the debit and credit of each account are to be determined according to the following rules:

To ascertain and record the debit-credit of transactions or accounts, account classification is necessary. Accounts can be divided into two categories.

- Traditional Method

- Modern Method.

#1. Traditional Method

According to the type or nature of the traditional system, accounts can be divided into three categories.

- Personal Account

- Assets Account

- Nominal or Income-Expenditures Account

The traditional method of determining debit and credit is shown below with examples:

- Personal account:

The person or institution that receives benefits is to be debited, and the person or institution that gives benefits is to be credited.

Examples:

Received Cash of $1,000 from Smith. Here, one accounting party in this transaction is Smith, who is the beneficiary. So Smith’s account has to be identified as credit.

Goods sold on credit to ABC & Co. for $5,000. Here, one accounting party in this transaction is ABC & Co. which is an artificial person taking advantage. So ABC & Co.’s account has to be identified as debit.

Paul brought $10,000 in cash as capital to the business. One party in this transaction is the capital account, which represents the owner, Paul.

So a capital account is a representative individual account that provides benefits. So here, the capital account has to be credited.

- Asset Account:

In a transaction, an asset that comes to the organization is debited, and an asset that goes out of the organization is credited.

Example:

Furniture is purchased at $5,000 in cash. In this case, the asset called furniture comes, the furniture account is debited. On the other hand, the cash account is credited as the cash assets go away.

- Nominal or Income-Expenditure Account:

Accounts relating to expenses and losses are to be debited; accounts relating to income are to be credited.

Examples:

Salaries are paid to the employees $3,000. In this case, the salary account has to be recorded as debit as it indicates the expense of the institution.

The commission received was $4,000. In this case, the commission indicates the income of the organization. Therefore, the commission account has to be recorded as a credit.

The following table summarizes the rules for determining the debit and credit of an account from a transaction in the traditional method.

| 1. | Personal Account | Person or organization or representative person receiving the benefit or value | Debit |

| Personal Account | Person or organization or representative person providing the benefit or value. | Credit | |

| 2. | Asset Account | The asset comes to the organization | Debit |

| Asset Account | An asset goes away from the organization | Credit | |

| 3. | Nominal or Income -Expenditure Account | Cost, expense, or loss. | Debit |

| Nominal or Income -Expenditure Account | Income or profit. | Credit |

#2. Equation Method

According to the opinion of modern accountants, the debit and credit of each transaction are determined using the accounting equation.

Debit and credit accounts are determined based on changes in the elements of the accounting equation.

The traditional method for calculating debit credit is described below, along with examples.

The accounting equation is as follows:

Assets = Liabilities

Or

Assets = Liabilities + Owner’s Equity

Or

Assets=Liabilities+Capital+Revenues-Expenses-Drawings

Therefore, in brief, the elements of the accounting equation are A, L, C, R, E, and D.

For every transaction, one or more elements of the accounting equation are changed, i.e., one element increases or one element decreases.

According to this change or increase-decrease of elements, debit and credit are determined.

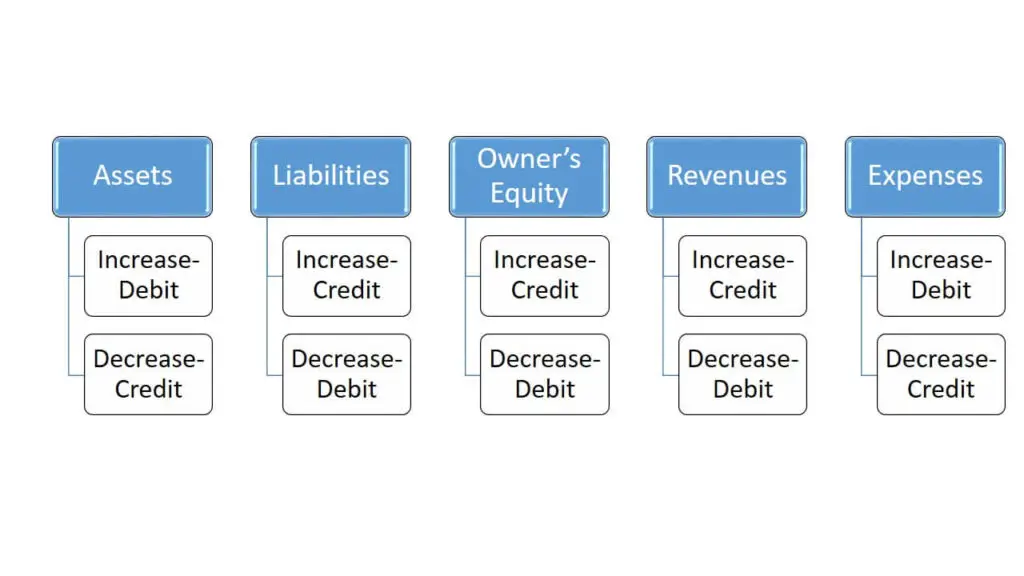

1. Assets:

Assets may increase or decrease as a result of transactions. For example, buying furniture increases assets, while selling it decreases assets. An asset’s increase is a debit, while its decrease is a credit.

2. Liability:

Liability, like assets, can be increased or decreased. For instance, taking out a bank loan increases liability, whereas making installment payments reduces it.

The liability is the inverse of an asset. As a result, an increase in liability is a credit, whereas a decrease in liability is a debit.

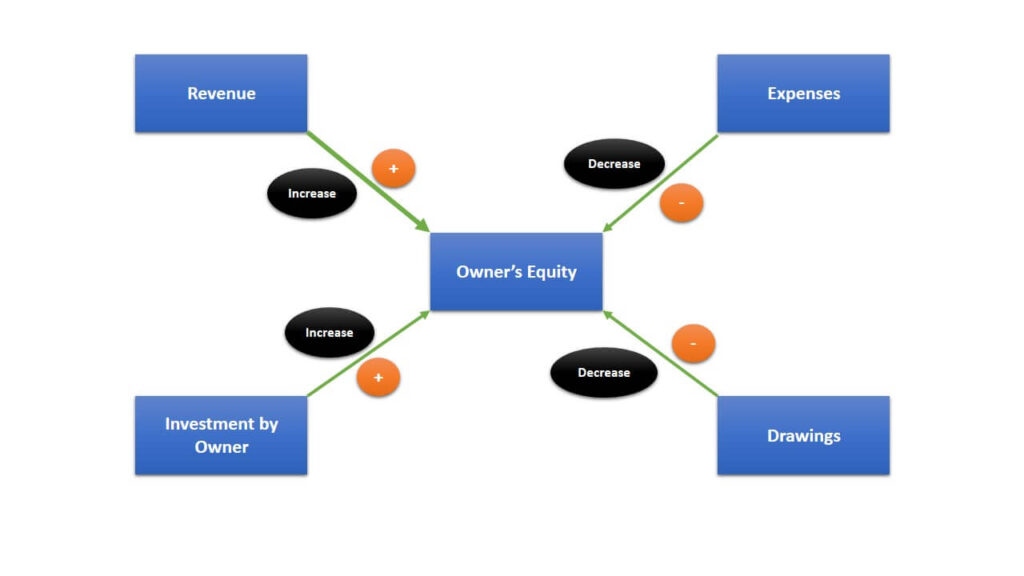

3. Owners’ Equity:

The owner brings capital to launch the business. As a result, the equity of the owner increases. Again, withdrawing cash by the owner from the business reduces the owner’s equity. Owner’s

Equity is a type of liability for the company. Because, according to accounting principles, the owner and the business have separate identities. As a result, if the owner’s equity increases, it is a credit, whereas if it decreases, it is a debit.

It should be kept in mind that, capital increases or decreases due to an increase or decrease in income and expenses, i.e., an increase in income increases capital, and an increase in expenditure decreases capital.

The diagram below depicts how the various elements affect the owner’s equity.

4. Income:

The sole goal of business is to make a profit, and the owner is the only one who cares about it. In reality, profit is the portion of income that exceeds expenses.

As a result, we can say that income raises an owner’s equity. As a result, an increase in income is a credit, whereas a decrease in income is a debit.

5. Expense:

Expense is the total opposite of income. Because income increases the owner’s equity while expenses decrease it, an increase in expenses is a debit and a decrease is a credit.

Based on the above elements of the accounting equation, the debit and credit of the accounting parties in the transaction can be determined by the following rules:

| Events | Accounts Head | Debit/Credit |

| When an asset increases | Corresponding asset account | Debit |

| When an asset decreases | Corresponding asset account | Credit |

| When liability increases | Corresponding liability account | Credit |

| When liability decreases | Corresponding liability account | Debit |

| When the owner’s equity (capital) increases | Corresponding owner’s equity account | Credit |

| When the owner’s equity (capital) decreases | Corresponding owner’s equity account | Debit |

| When an income increases | Corresponding income account | Credit |

| When an income decreases | Corresponding income account | Debit |

| When an expense increases | Corresponding expense account | Debit |

| When an expense decreases | Corresponding expense account | Credit |

The diagram below summarizes the debit/credit rules and how they affect each type of account.

Identifying Debit and Credit: Practical Problems and Solutions

Identify the debit and credit of the following transactions.

- Mr. Paul has started a business with a capital of $ 30,000.

- Furniture purchased for business $6,000.

- Salary paid to employee $4,000

- Purchase of goods $15,000

- $10,000 is deposited in the bank.

- Goods sold for $25,000

- Cheque paid for advertisement $5,000

- The commission received $2,000.

- Interest received from the bank of $1,500.

- Goods sold on credit for $12,000.

- Cheque paid for rent of $5,000

- $7,000 has been withdrawn from the bank for business purposes.

Solutions:

| No. | Accounts Head | Debit | Credit | Explanations |

| 1 | Cash Account | 30,000 | The cash account has been debited as the business’s cash (asset) increased. The owner’s equity increased as a result of bringing cash into the business. So, the Capital A/c has been credited. | |

| Capital Account | 30,000 | |||

| 2 | Furniture Account | 6,000 | When purchasing furniture, assets increased while cash decreased. As a result, the furniture account has been debited and the cash account has been credited. | |

| Cash Account | 6,000 | |||

| 3 | Salaries Account | 4,000 | Paying salaries increased the business’s expenses while decreasing its cash. As a result, the salary account has been debited and the cash account has been credited. | |

| Cash Account | 4,000 | |||

| 4 | Purchase Account | 15,000 | The business’s expenses increased while its cash decreased as a result of the purchase of goods. As a result, the Purchase account has been debited and the Cash account has been credited. | |

| Cash Account | 15,000 | |||

| 5 | Bank Account | 10,000 | When cash is deposited into a bank, the amount deposited increases while cash in hand decreases. As a result, the bank account has been debited and the cash account has been credited. | |

| Cash Account | 10,000 | |||

| 6 | Cash Account | 25,000 | The business’s income and cash flow increased as a result of selling goods in cash. As a result, the Cash Account has been debited and the Sales Account has been credited. | |

| Sales Account | 25,000 | |||

| 7 | Advertisement Account | 5,000 | The cost of advertising increased, while the amount deposited in the bank decreased. As a result, the advertisement account has been debited & bank account has been credited. | |

| Bank Account | 5,000 | |||

| 8 | Cash Account | 2,000 | Income and cash increased as a result of receiving commissions. As a result, the Cash account has been debited & commission account has been credited. | |

| Commission Account | 2,000 | Income and cash increased as a result of receiving commissions. As a result, the Cash account has been debited & commission account has been credited. | ||

| 9 | Bank Account | 1,500 | Because of the interest allowed by the bank, the amount deposited in the bank increased, as did the income. As a result, the bank account has been debited and the bank interest account has been credited. | |

| Bank Interest Account | 1,500 | |||

| 10 | Debtors Account | 12,000 | Businesses gain the right to receive money from debtors when they sell goods on credit and their income increases. As a result, Debtors A/c has been debited & Sales A/c has been credited. | |

| Sales Account | 12,000 | |||

| 11 | Rent Account | 5,000 | Rent payments increased in expense, while check bank deposits decreased. As a result, Rent A/c has been debited & Bank A/c has been credited. | |

| Bank Account | 5,000 | |||

| 12 | Cash Account | 7,000 | Taking cash from the bank increased cash in hand and decreased bank deposits. As a result, the cash account has been debited and the bank account has been credited. | |

| Bank Account | 7,000 |

I hope you have a clear understanding of debit and credit in accounting by the end of this article. Please leave a comment if you have any questions about debit and credit.

You can also read: