Why is Accounting Called the Language of Modern Business? [With PDF]

In the dynamic world of modern business, communication is key. Just as languages help humans connect, share ideas, and build relationships, accounting serves as the universal language that businesses use to communicate financial health and operational efficiency.

But why is accounting called the “language of modern business“? In this tutorial, we’ll explore the concept, understand its importance, and see how it impacts businesses today.

Why Understanding Accounting Matters

Imagine running a company without knowing how much profit you’re making or where your expenses are going. It would be like trying to drive a car blindfolded!

Accounting provides the roadmap, offering clarity, direction, and insights that ensure businesses stay on course. By understanding the “language” of accounting, organizations can:

- Make informed decisions.

- Communicate effectively with stakeholders.

- Ensure regulatory compliance.

Without it, chaos would ensue in the financial world. Let’s dive into the reasons behind accounting’s esteemed title as the language of modern business.

What Makes Accounting a Universal Business Language?

1. Standardization Across Borders

Accounting practices are guided by globally accepted frameworks like the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). These standards ensure:

- Consistency: Financial reports look and feel the same across industries.

- Comparability: Investors can compare businesses in different regions.

- Transparency: Clear communication builds trust among stakeholders.

Example: A multinational corporation operating in the U.S. and Europe can use GAAP and IFRS to produce comparable financial reports, aiding global decision-making.

2. Facilitating Financial Communication

Accounting transforms complex business transactions into digestible financial statements, such as:

- Income Statement: Shows profitability.

- Balance Sheet: Reflects financial health.

- Cash Flow Statement: Tracks liquidity.

These statements act as the “words and sentences” of the business world, telling a story about performance and potential.

Ask Yourself: How would you explain a company’s financial performance if there were no standardized accounting reports?

The Role of Accounting in Modern Business

1. Decision-Making Tool

Accounting equips businesses with data to make strategic decisions. From launching new products to cutting costs, accounting insights drive success.

Case Study: A retail chain uses cost accounting to identify that one product line consistently generates losses. By discontinuing it, they increase overall profitability.

2. Performance Measurement

Through key performance indicators (KPIs) derived from accounting data, businesses can:

- Track progress.

- Set realistic goals.

- Align with market trends.

Actionable Tip: Use accounting software to generate weekly sales reports and monitor trends.

3. Risk Management

Accounting identifies financial risks by:

- Highlighting cash flow issues.

- Detecting discrepancies in transactions.

- Preparing for economic downturns.

Example: A startup uses cash flow projections to anticipate funding needs and avoid liquidity crises.

How Accounting Connects Stakeholders

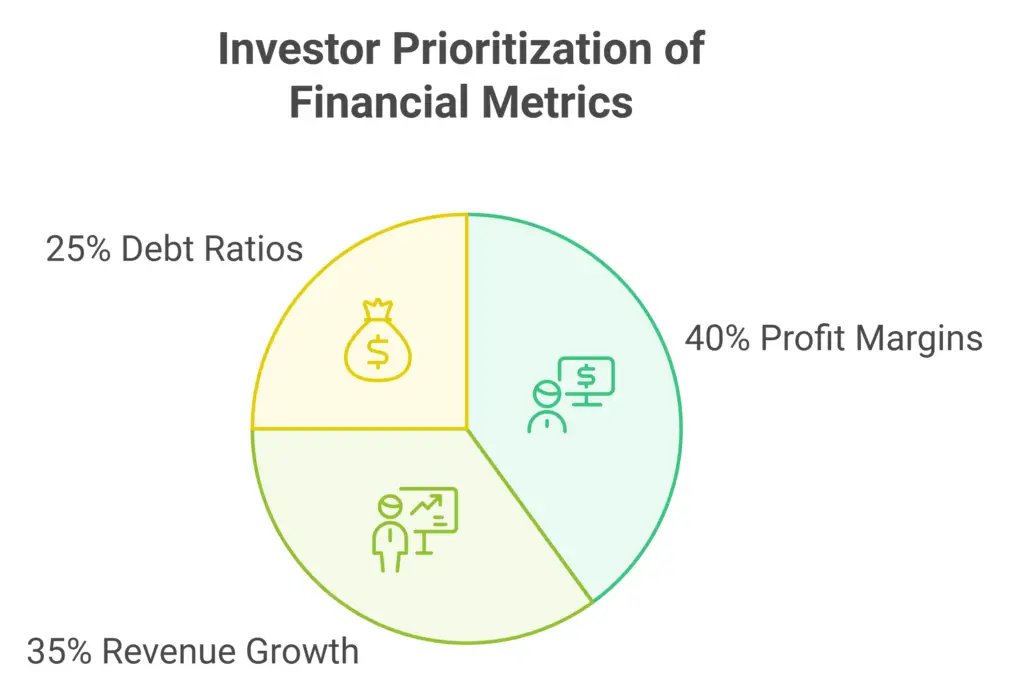

1. Communicating with Investors

Investors rely on accounting reports to:

- Assess profitability.

- Determine risk levels.

- Evaluate return on investment (ROI).

2. Ensuring Regulatory Compliance

Governments mandate accurate accounting to:

- Collect taxes.

- Prevent fraud.

- Monitor economic health.

Example: A company’s failure to comply with accounting standards leads to penalties, highlighting the importance of accurate reporting.

Test Your Knowledge

Explanation: While accounting supports business operations, it doesn’t directly handle marketing strategies.

Challenges in Accounting and Overcoming Them

1. Complexity of Regulations

Businesses face challenges in understanding and adhering to accounting standards. Investing in expert advice or software can simplify compliance.

2. Keeping Up with Technology

Modern accounting tools, like cloud-based platforms and AI-powered software, are transforming the field. Staying updated is crucial for efficiency.

Practical Tip: Explore free tutorials on platforms like YouTube to master popular tools like QuickBooks or Xero.

Key Takeaways

- Accounting serves as the universal language for communicating financial information.

- It standardizes business practices, enabling transparency, comparability, and informed decision-making.

- Modern tools and techniques are making accounting more accessible and impactful than ever before.

Want to learn more about accounting’s role in business? Explore our:

- What are the top 10 objectives of accounting?

- What is the importance of accounting in business?

- What is the difference between financial accounting and management accounting?

By mastering the language of accounting, you’ll gain the confidence and skills to excel in the modern business landscape. Start your journey today!