Accounting Cycle-Definition, Steps, Examples, and Explanation [With PDF]

In this article, we will learn about the accounting cycle, including its definition, various steps, examples, and many more.

So let’s get started.

What is Accounting Cycle?

The accounting cycle refers to the cycle in which the steps of the accounting process revolve.

According to the going concern concept, a business is expected to continue indefinitely. This indefinite period of time is divided into short periods to determine the business organization’s results and financial status.

At this point, all accounting activities are rotated through a specific sequential process. The accounting cycle is a continuous process.

The accounting cycle is essentially the periodic expression of an organization’s accounting functions.

Every year, large organizations organize millions of transactions. This large number of transactions is initially recorded in the primary book using various source documents (e.g., receipts, memos, vouchers, invoices, debit books, etc.).

Following that, the parties involved in all of the transactions included in the journal are entered into the ledger by categorizing them according to the specific person, organization, income, expenditure, liability, or property account.

A trial balance is then prepared to verify the mathematical accuracy of the account with the ledger’s arrears.

Financial statements such as trading accounts, profit-loss accounts, and balance sheets are prepared following the adjustment of the corresponding fiscal year’s arrears and advances.

In the end, all financial statements are thoroughly explained and analyzed.

The accounting cycle refers to the regular and periodic rotation and repetition of accounting activities.

Accounting cycle is a series of steps related to accumulating, processing and reporting useful financial information that are performed during an accounting period.

Hermanson & Others

From the above discussion, we can say that the accounting cycle is a comprehensive accounting process that begins with the identification of the transaction and its normalization, progresses to the final stage of accounting activities step by step, initiates the activities for the following year by opening journal entries, and repeats the process to get to the final stage of accounting activities.

As long as a business is in operation, this accounting process continues.

Accounting Cycle Steps

The steps of the accounting cycle depend on how an organization conducts its accounting process. Therefore, the steps of the organization’s accounting cycle can be different. The following are some common steps that can be taken in the accounting cycle:

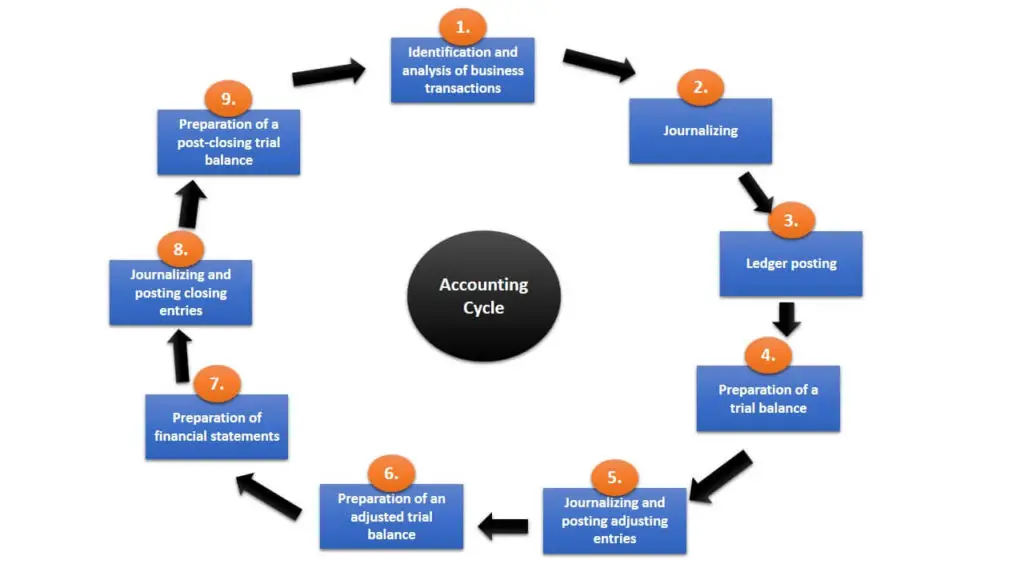

The following diagram includes an explanation along with the various steps or phases of the accounting cycle. The accounting cycle is actually a stage-by-stage expression of an organization’s accounting activities.

The diagram below shows the nine steps in the accounting cycle:

- Identification and analysis of business transactions.

- Journalizing

- Ledger posting

- Preparation of a trial balance.

- Journalizing and posting adjusting entries.

- Preparation of an adjusted trial balance.

- Preparation of financial statements

- Journalizing and posting closing entries.

- Preparation of a post-closing trial balance.

If a worksheet is made, steps 4, 5, and 6 are included in it. If reversing entries are prepared, they happen between Steps 9 and 1.

Throughout the accounting period, steps 1-3 could happen every day. On a regular basis, such as monthly, quarterly, or annually, businesses complete Steps 4–7. Closing entries and a post-closing trial balance (steps 8 and 9) typically happen only at the conclusion of a business’s annual accounting period.

The steps of the accounting cycle are described below:

Step 1: Identification and analysis of business transactions:

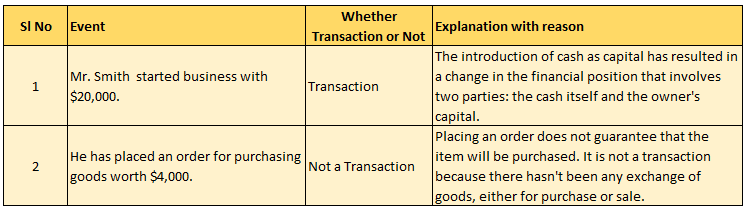

The identification of transactions is the first step in the accounting cycle. In a business concern or in any other organization, numerous events take place every day. Although not all events are transactions. There is accounting for the events that are transactions.

Therefore, transactions are defined as events that are measured in monetary terms and for which the financial position of an organization changes. In the following stage, accounts are maintained for those transactions.

For example, a purchase order for $15,000 was placed with a vendor. This is not a transaction because there is no exchange of money.

The purchase of goods for $15,000 in cash, on the other hand, qualifies as a transaction because it affected the company’s finances.

As a result, transactions are defined as events that can be measured in terms of money and for which there are financial changes.

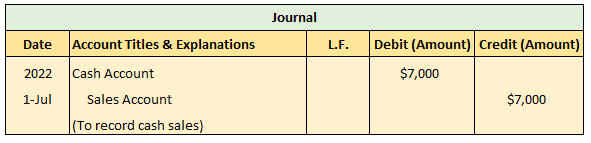

Step 2: Journalizing:

Journalizing is the second step of the accounting cycle. In this stage of the journal, transactions are recorded in chronological order of dates, debiting one account and crediting the other with a brief explanation.

Various journal books, such as sales books, purchase books, cash books, and so on, are used to record transactions in the primary book of accounts.

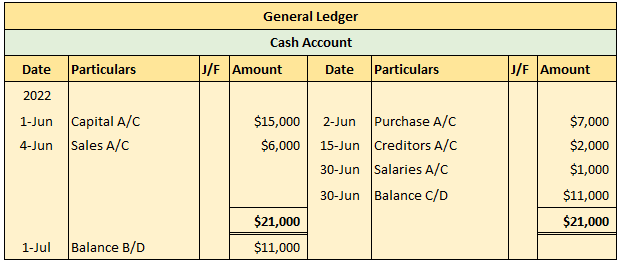

Step 3: Ledger posting:

Ledger posting is the third step in the accounting cycle.

A ledger is a book where transactions are permanently recorded in a classified and summarized way. “Posting” is the process of entering transactions into the ledger. It is known as the ” permanent book of account” because all transactions are ultimately and permanently recorded in this book.

It is possible to obtain various pieces of information regarding business from the balances of the ledger accounts. That is why the ledger is referred to as the king of all accounting books.

For example, salaries are paid at various times during an accounting period. However, the amount of total salary paid within that accounting period at the end of the accounting period can be determined from the salary account.

Similarly, even if different amounts are purchased at various times during the accounting period, the total amount purchased at the end of the accounting period can be determined using the purchasing account.

As a result, the balance of the accounts at the end of the accounting period will show the relevant income, expenditure, assets, liabilities, and capital.

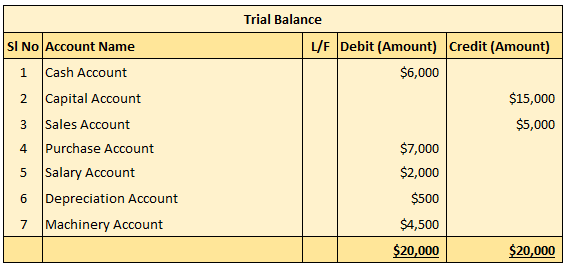

Step 4: Preparation of a trial balance:

Preparing the trial balance is the fourth step of the accounting cycle. A trial balance is prepared using the ledger account balances following the preparation of the ledger accounts.

A trial balance is a statement that includes the ledger account’s debit and credit balances and is prepared at a specific time of the period’s end.

The purpose of the trial balance is to simplify the financial statement preparation process and demonstrate the ledger account’s accuracy in math.

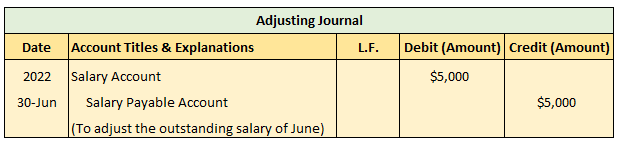

Step 5: Journalizing and posting adjusting entries:

The fifth step in the accounting cycle is journalizing and posting adjusting entries.

A variety of accruals and deferrals-related information must be accounted for in order to determine the operating results of a given period and the precise financial position of a specific business concern.

Adjusting journal entries, also known as “adjusting entries,” are used to correct information that was either not accounted for or was incorrectly accounted for.

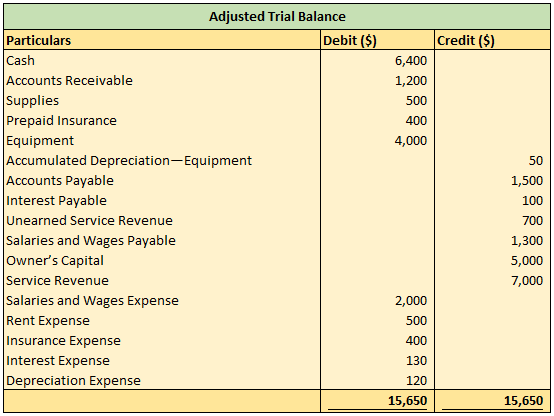

Step 6: Preparation of an adjusted trial balance:

Preparing an adjusted trial balance is the sixth step in the accounting cycle.

An organization must prepare financial statements at the end of each accounting period.

However, the information pertaining to the specific period that affects the financial statements must first be journalized and re-posted in the ledger accounts in order to determine the relevant ledger balances at the end of the period.

The trial balance that is prepared using these ledger balances is known as the adjusted trial balance.

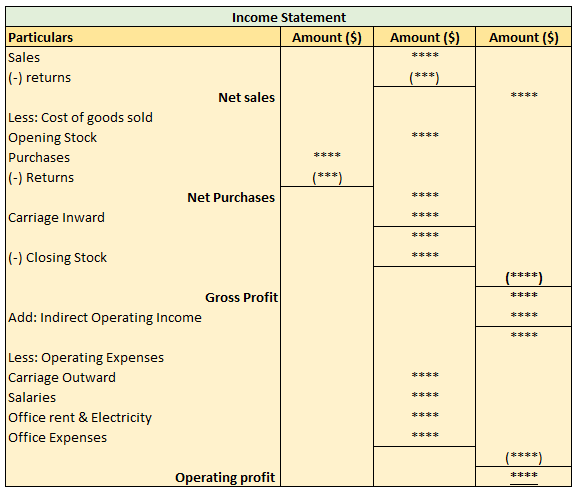

Step 7: Preparation of financial statements:

The preparation of financial statements is the seventh stage of the accounting cycle. The financial statements are prepared using an adjusted trial balance.

Income statements and balance sheets are the most important financial statements. At the end of a specific accounting period, financial statements are created to show the precise financial position of an organization.

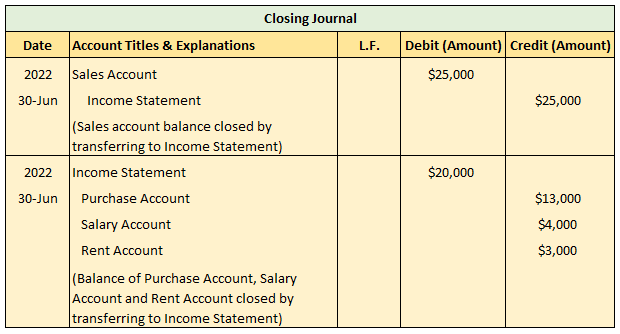

Step 8: Journalizing and posting closing entries:

The eighth step in the accounting cycle is journalizing and posting closing entries. The periodic expenses and income, along with the remaining balance of the income statement, are generally closed by passing closing entries after the financial statement has been prepared.

Since their utilities ceased during the specific accounting period and were not carried over to the following year like assets and liabilities, closing expenses and incomes became necessary.

Step 9: Preparation of a post-closing trial balance:

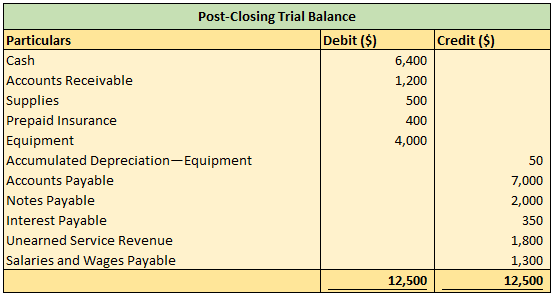

Preparing a post-closing trial balance is the last step of the accounting cycle.

Following the journalizing and posting of closing entries, the post-closing trial balance shows the permanent accounts and their balances.

The post-closing trial balance is used to demonstrate the equality of the balances carried over from one accounting period to the next in permanent accounts.

The post-closing trial balance will only include accounts from the permanent balance sheet because all temporary accounts will have zero balances.

Accounting cycle optional steps

The accounting cycle also includes two additional optional steps. As you may already be aware, businesses might use a worksheet when creating adjusting entries and financial statements. They can also use reversing entries, which are covered in more detail below.

1. Worksheet:

The worksheet is a multi-column statement that is created at the end of each accounting period.

Large businesses with a comparatively high number of accounts and adjustments may choose to skip this step of the accounting cycle.

The worksheet is set up to make it simple and accurate to prepare financial statements. A worksheet is created prior to the creation of financial statements.

Trial balance, adjustment, adjusted trial balance, income statement, and balance sheet are the steps of the worksheet.

A worksheet is an addition to the financial statements. The worksheet is used to prepare the financial statements.

2. Reversing entries:

Reversing entries is an optional step in the accounting cycle.

Some accountants prefer to make a reversing entry at the start of the following accounting period in order to reverse specific adjusting entries.

An adjusting entry made in the previous period is completely reversed by a reversing entry. Reversing entries is a bookkeeping technique that is optional; it is not an essential step in the accounting cycle.

Accounting Cycle Avoidable Step

Correcting or error rectification entries are the avoidable step in the accounting cycle. which is explained further below:

Correcting entries:

Correcting entries is an avoidable step in the accounting cycle.

Regrettably, mistakes can happen during the recording process. As soon as errors are found, businesses should journal about them and post corrective entries. There is no need for correcting entries if the accounting records are error-free.

There are a few distinctions between adjusting entries and correcting entries that you should be aware of.

First off, the accounting cycle includes adjusting entries as a necessary step. On the other hand, if the records are error-free, correcting entries is not required.

Second, businesses only record and journalize adjustments at the end of an accounting period. Contrarily, whenever a mistake is found, businesses make corrective entries.

Finally, adjusting entries always have an impact on at least one account on the income statement and one account on the balance sheet. Contrarily, making corrections to entries may involve any number of accounts that need to be adjusted. Before closing entries, corrected entries must be posted.

It is helpful to compare the incorrect entry with the correct entry in order to identify the correct entry.

This makes it easier to determine which accounts and amounts need to be corrected and which ones do not. The accountant compares and then enters a correction to the accounts.

I believe that by the end of this article, you have a clear understanding of the accounting cycle. If you have any questions or want to learn more about the accounting cycle, please leave a comment.

You can also read: