Adjusting Entries-Definition, Example, Types, Importance, and Format [Notes with PDF]

In this article, we will learn in detail about adjusting entries including their definition, importance, types, example, format, and many more.

Definition of Adjusting Entries

After making a trial balance, the accountant must calculate the actual profit or loss of the business by correcting the error.

In this case, only the accounts of trial balance should not be taken into consideration. All income and expenditure of the respective year should be taken into consideration.

Many incomes and expenses are incurred until the end of the year but are not properly recorded on that day. We can see that not all transactions for the fiscal year are completed at that time.

For example, a December salary is paid in the first half of January. Again, some transactions are completed in advance and must be accounted for in the appropriate accounting period.

And the journal entries used to account for all of these transactions are referred to as adjusting entries. It is also known as the actual journal.

“Adjusting entries are journal entries to assign revenues to the period in which earned and to match revenue and expenses.”

Pyle & Larson

Simply put, adjustment entries are used to reconcile (add or subtract) income arrears, expenditure or expense arrears, advance payments, unpaid reserves, depreciation, and so on with the respective accounts.

Adjusting entries are made at the end of an accounting period to update the balance of accounts.

The trial balance does not include adjustment journal entries. As a result, according to the double-entry accounting system, their accounting must be shown twice in final accounts.

Based on the above definitions, we can conclude that unadjusted transactions must be accounted for prior to the preparation of financial statements in order to calculate an accurate profit-loss and obtain an accurate picture of assets and liabilities. Adjustment entries are the journal entries used to account for these transactions.

Importance of Adjusting Entries

One of the main goals of accounting is to determine the result of a transaction at the end of each accounting period and to display the actual financial position.

Adjusting entries are required to confirm revenue recognition principles and matching principles. This is required for accurate financial reporting of a financial year of an organization.

As a result of adjusting entry, it is possible to know the exact profit or loss of the organization for a certain period of time as well as accurate information about the assets, liabilities, and ownership of the organization.

It is impossible to determine the exact assets, liabilities, proprietorship, profit, or loss of the organization if the accounting period’s outstanding expenses, unearned income, asset depreciation, expenses paid in advance, and income due in advance are not taken into account.

Many times, the trial balance may not have been updated. In particular, due to a variety of factors such as advance payment, arrears, assets depreciation, receipt of term bill, used supplies, determination of the market value of the property at the end of the year, and so on.

The importance of adjusting entries is explained further below:

- Adjusting entries are required in order to maintain accurate accounts for the respective accounts.

- Adjusting entry is important for proper accounting of arrears or advance income and expenses.

- Adjusting entries are important In order to adjust the expenditure of that year with the income of the corresponding accounting period.

- Adjusting entries are important for the effective application of the accounting policy, such as accounting year policy, revenue recognition policy, matching policy, and going concern concept.

- Businesses buy one-time supplies. It is impossible to calculate the exact profit without determining how much of it is unused during the accounting period. Adjusting entries for used supplies as cost and unused supplies as assets must be included in financial statements.

- Excluding transactions, i.e. transactions organized within the respective accounting period but not available for bill payment, such as utility bills (electricity bills, water bills, gas bills), is important for accounting adjusting entries.

- The importance of adjusting entry is essential to show the depreciation account of fixed assets over time.

- Adjusting entries are important for accurate profit-loss calculation.

- In order to show a proper and fair evaluation of an organization’s assets, necessary adjustments must be made to the relevant income, expenditure, assets, and liabilities of that organization. When the balance sheet is created without an adjusting entry, the actual value of the asset is not reflected. As a result, the significance of adjusting entry is enormous.

- Adjusting entries are necessary for the proper valuation of unused stocks.

Based on the preceding discussion, it appears that the importance of adjusting entries is undeniable.

Types of Adjusting Entries

The adjustment entry is mainly divided into advance and accruals. Each is again divided into two parts. The classification of adjusting entry is discussed below:

- Prepaid or Unexpired Expenses:

Expenses that are paid in cash and recorded as assets before use are called prepaid expenses.

For example, insurance paid in advance $1200 and $100 has expired in the current accounting period. In this case, the adjusting entry will be as follows:

| Date | Account Titles | Ref. | Debit ($) | Credit ($) |

| Insurance Expense A/C | 100 | |||

| Prepaid Insurance A/C | 100 |

2. Unearned Revenue or Advance income:

Advance income or unearned income is generated when a customer pays a cash advance to the seller company before receiving the product or service.

For example, unearned income is $2400, this year the income has been generated at $800. In this case, the adjusting entry will be as follows:

| Date | Account Titles | Ref. | Debit ($) | Credit ($) |

| Unearned Revenue A/C | 800 | |||

| Revenue A/C | 800 |

3. Outstanding or Unpaid Expenses:

Expenses that have occurred but have not been paid are called outstanding or unpaid expenses.

For example, salary, rent, taxes, and interest may be due. At the time of adjusting entry, the expense account will be debited and the liability account will be credited.

For example, there is a salary arrear of $1,000. Adjusting entry will be as follows:

| Date | Account Titles | Ref. | Debit ($) | Credit ($) |

| Salary Expense A/C | 1,000 | |||

| Salaries Payable A/C | 1,000 |

4. Outstanding or Receivable Income:

Service has been provided i.e. income has been earned but money has not been received yet it is called outstanding income or income receivable. Both assets and income increase during the adjusting entries of such arrears or receivables.

For example, outstanding service revenue is $800. The adjusting entry will be as follows:

| Date | Account Titles | Ref. | Debit ($) | Credit ($) |

| Service Revenue Receivable A/C | 800 | |||

| Service Revenue A/C | 800 |

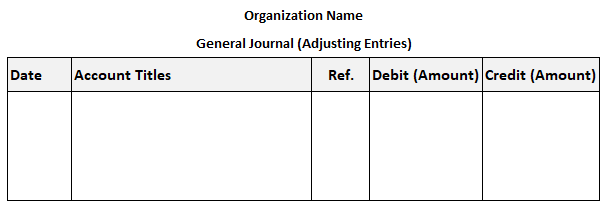

Format of Adjusting Entries

The format of adjusting entries is as follows:

Example of Adjusting Entries

Mr. Paul starts a computer service business on April 1, 2022. At the end of April 30, 2022, Mr. Paul tried to prepare monthly financial statements. He has the following information for the month.

- Salaries accrued $500 on April 30 and will be paid in May.

- Mr. Paul borrowed $12,000 from a local bank on a 10-year mortgage on April 1. The annual rate of interest is 10%.

- Utility bills that were incurred but not paid by April 30 totaled $200.

- In April, unrecorded service revenue totaled $300.

- He purchased $600 of supplies. On April 30, it was determined that $500 in supplies were on hand.

Prepare the adjusting entries for these transactions.

The adjusting entries of the above-mentioned transactions are as follows:

Mr. Paul

General Journal (Adjusting Entries)

| Date | Account Titles | Ref. | Debit ($) | Credit ($) |

| 2022 April-30 | Salaries Expense A/C | 500 | ||

| Salaries Payable A/C | 500 | |||

| April-30 | Interest Expense A/C | 100 | ||

| Interest payable A/C | 100 | |||

| April-30 | Utility Expense A/C | 200 | ||

| Utility Payable A/C | 200 | |||

| April-30 | Accounts Receivable A/C | 300 | ||

| Service Revenue A/C | 300 | |||

| April-30 | Supplies Expense A/C | 100 | ||

| Supplies A/C | 100 | |||

| 1,200 | 1,200 |

You can also read: