Closing Entries-Definition, Example, Purpose and Preparation [With PDF]

In this article, we will learn in detail about closing entries, including their definition, purpose, necessity, preparation time, preparation, example, and many more.

So let’s get startted.

What are the closing entries?

Closing entries are journal entries required to close all nominal or temporary accounts at the end of a financial or accounting period or year.

At the end of each accounting period, financial statements are prepared to determine the financial status of the company.

The nominal account or revenue accounts, i.e. income and expenses, are closed by providing closing entries after the financial statements are prepared. Because the effect of nominal accounts cannot be shown in the following year, they are closed in the year in which they are created.

Closing entries is entries made to close and clear the revenue and expense accounts and to transfer the amount of the net income or loss to a capital account or accounts or to the retained earning accounts.

Pyle & Larson

In each temporary account, closing entries also result in a zero balance. The temporary accounts are now ready to gather data for the next accounting period, which will be distinct from the data from previous periods.

What is the purpose of closing entries?

The primary purpose of closing entries is to close and clear temporary accounts such as revenue, expenses, and the owner’s drawing accounts, as well as to transfer balances to the owner’s capital account at the end of each accounting period.

The income-expenditure account of the business organization is related to the corresponding accounting period. The utility of these ends in the relevant accounting period.

All these accounts are shown in the income statement, and their effect is short-term. That is, their utility ends during the relevant accounting period.

The next year, their balances can not be transferred. Such accounts are closed during the current accounting period.

A closing entry is provided for the closing of income-expenditure accounts. All these accounts are nullified by posting closing entries.

What is the significance of closing entries?

The accounting cycle requires journalizing and posting closing entries. This step is completed after the financial statements have been prepared.

Companies generally journalize and post-closing entries only at the end of the annual accounting period, in contrast to the steps in the cycle.

As a result, all temporary accounts will have data for the entire calendar year.

Companies could close each income statement account to the owner’s capital immediately while making closing entries.

However, doing so would result in an excessive amount of detail in the capital account of the permanent owner.

Instead, companies transfer the net income or net loss from the revenue and expense accounts to a temporary account called “Income Summary,” and then to the owner’s capital.

When the credit balance of the revenue account and the debit balance of the expenses account are transferred to the summary account, the account’s balance is either net income or a net loss.

This follows the rule that credits are used to record increases in owners’ equity and debits are used to record decreases.

Which accounts have a zero balance after closing entries?

The following temporary accounts have a zero balance after closing entries have been journalized and posted:

- Revenue accounts

- Expenses accounts

- Owner’s drawing accounts.

When are the closing entries made?

Closing entries are made at the end of every accounting period.

The company transfers temporary account balances to the permanent owner’s equity account, Owner’s Capital, using closing entries at the end of each accounting period.

Where does the company keep track of its closing entries?

In the general journal, businesses record closing entries. Closing Entries, a center caption inserted between the last adjusting entry and the first closing entry in the journal, identify these entries.

The closing entries are then posted to the ledger accounts by the company. Companies usually create closing entries directly from the ledger’s adjusted balances.

What factors are to be considered in preparing the closing entries?

When preparing closing entries, there are a few things to bear in mind.

- Avoid accidentally doubling rather than zeroing the revenue and expense balances.

- Do not use the Income Summary account to close the Owner’s Drawings. The owner’s drawings are neither an expense nor a factor in calculating net income.

Preparation of closing entries

There is no future benefit or utility from income-expenditure accounts. Therefore, they are not transferred to the next year. These accounts are closed by transferring them to an income summary account.

The following steps need to be taken to close the temporary accounts.

A. The normal balance for all revenue accounts is credit. All revenue accounts will be zero after debiting the revenue account and crediting the income summary account, and the revenue account will be closed at the same time.

B. The normal balance of all expenses is debit. All expense accounts will be zero, and the expenses account will be closed, by crediting the expenses account and debiting the income summary account.

C. If the income exceeds the cost in the income summary account, the result is a net profit, for which income summary account shows a credit balance.

On the other hand, if the cost exceeds the income, a net loss occurs. The income summary account for which there is a debit balance.

If there is a net profit, the balance of the income summary account is also zeroed by debiting the income summary account and crediting the capital account.

As a result, the income summary account is also closed. If there is a net loss, the income summary account is also closed, with the income summary account being credited and the capital account being debited.

D. The owner’s withdrawing account’s normal balance is debit. The owner’s drawing account will be zero and the owner’s drawing account will be closed by crediting the owner’s drawing account and debiting the capital account.

To close the major temporary accounts, you’ll need to make the following journal entries:

1. For closing revenues

| Date | Accounts title and explanation | Ref. | Debit | Credit |

| All Revenue A/C | *** | |||

| Income Summary A/C | *** | |||

| (To close revenue accounts) |

2. For closing expenses.

| Date | Accounts title and explanation | Ref. | Debit | Credit |

| Income Summary A/C | *** | |||

| All Expenses A/C | *** | |||

| (To close expenses accounts) |

3. To Record the Profit

| Date | Accounts title and explanation | Ref. | Debit | Credit |

| Income Summary A/C | *** | |||

| Capital or Retained Earnings A/C | *** | |||

| (To close or transfer net income to capital) |

4. To Record the Loss

| Date | Accounts title and explanation | Ref. | Debit | Credit |

| Capital or Retained Earnings A/C | *** | |||

| Income Summary A/c | *** | |||

| (To close or transfer net loss to capital) |

5. To Transfer the Dividends Declared

| Date | Accounts title and explanation | Ref. | Debit | Credit |

| Retained Earnings A/C | *** | |||

| Dividends A/c | *** | |||

| (To close dividend to retained earnings) |

6. To Transfer the Drawings

| Date | Accounts title and explanation | Ref. | Debit | Credit |

| Owner’s Capital A/C | *** | |||

| Owner’s Drawings A/c | *** | |||

| (To close drawings to capital) |

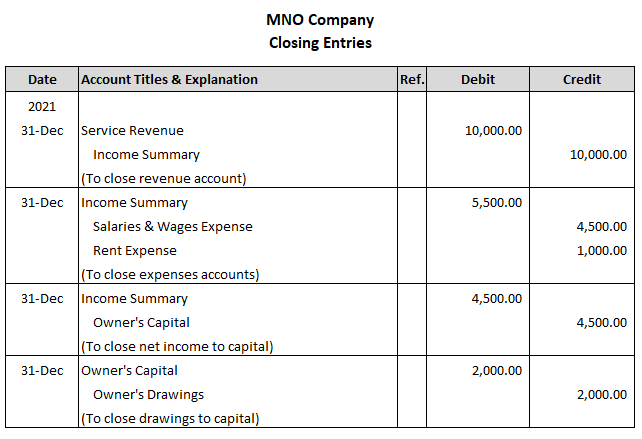

Example of closing entries

The following example of closing entries will assist you in quickly comprehending closing entries.

The worksheet for MNO Company shows the following in the financial statement columns:

- Service revenue $10,000

- Rent expense $1,000

- Salaries & wages $4,500

- Owner’s drawings $2,000

- Owner’s capital $20,000

Prepare the closing entries at December 31, 2021.

Solution:

The solution to this problem is as follows:

You can also read: