Limitations of Accounting: Understanding the Boundaries of Financial Reporting [With PDF]

Accounting is an indispensable tool for businesses, helping to track financial performance, ensure regulatory compliance, and inform strategic decisions. However, like any system, accounting is not without its limitations.

Understanding these limitations is crucial for professionals, students, and entrepreneurs to interpret financial data critically and make informed decisions.

In this article, we will explore the key limitations of accounting, provide actionable insights, and use relatable examples to illustrate these concepts.

Why Understanding Accounting’s Limitations Matters

Have you ever wondered why two companies in the same industry report vastly different profits despite similar operations? Or why financial reports sometimes fail to reflect the actual health of a business? These discrepancies often arise from the inherent limitations of accounting.

Accounting provides a structured way to record and analyze financial information, but it is not a perfect science. Factors such as subjectivity in decision-making, reliance on historical data, and external influences can impact the accuracy and usefulness of accounting reports. By understanding these limitations, you can:

- Avoid over-reliance on financial statements.

- Make more nuanced business decisions.

- Communicate effectively with stakeholders about financial results.

Key Limitations of Accounting

1. Historical Nature of Accounting

Accounting primarily records past transactions, making it less useful for predicting future trends. Financial statements, such as income statements and balance sheets, provide a snapshot of a company’s past performance but may not reflect its future potential.

Example:

A retail store’s financial statements show steady profits for the last five years. However, changing consumer preferences and increased competition could impact future earnings, which the financial reports do not indicate.

Actionable Tip:

Complement historical data with forward-looking tools such as financial forecasting and market analysis to gain a holistic view of a business’s prospects.

2. Subjectivity in Valuation

Many accounting practices involve subjective judgment, leading to variations in how financial information is recorded and interpreted. For example:

- Depreciation: Businesses can choose different methods (e.g., straight-line or reducing balance) to calculate depreciation, which impacts reported profits.

- Inventory Valuation: Choices like FIFO (First-In-First-Out) or LIFO (Last-In-First-Out) can lead to different cost of goods sold (COGS) values.

Case Study:

Two companies, A and B, use different depreciation methods for identical machinery. Company A reports higher profits by using a slower depreciation method, while Company B shows lower profits due to accelerated depreciation.

Test your knowledge:

If you were comparing these two companies as an investor, how would you account for these differences?

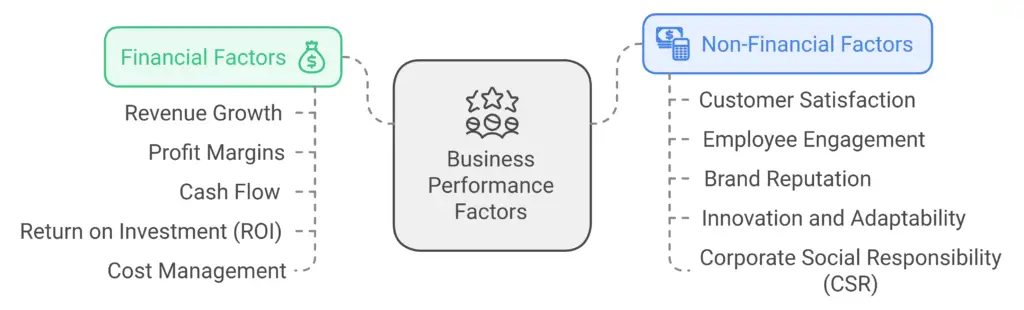

3. Ignoring Non-Financial Aspects

Accounting focuses solely on quantifiable financial data and often ignores non-financial factors that significantly impact a business’s success, such as:

- Employee satisfaction.

- Brand reputation.

- Environmental impact.

Example:

A company might report high profits but face long-term risks due to poor employee morale or negative public perception.

Financial and non-financial factors

Actionable Tip:

Incorporate non-financial metrics, such as customer satisfaction scores or sustainability reports, alongside financial statements to get a comprehensive view of business health.

4. Impact of Inflation

Accounting records transactions at their historical cost, which may not reflect their true value in times of inflation. This limitation can distort the financial position of a business.

Example:

A piece of land purchased for $50,000 in 1990 might be worth $500,000 today, but accounting records will still show the historical cost unless adjusted.

Test your knowledge with a quick quiz:

5. Inadequacy for Decision-Making

While accounting provides valuable insights, it often falls short in offering real-time data for quick decision-making. Traditional accounting methods may not keep pace with the dynamic nature of modern businesses.

Example:

A manufacturing firm relies on quarterly financial reports to assess performance. However, unexpected spikes in raw material costs during the quarter go unnoticed until the reports are finalized.

Practical Tip:

Adopt real-time accounting software to monitor financial metrics continuously and make timely decisions.

6. Susceptibility to Errors and Manipulation

Human errors, fraud, and creative accounting practices can compromise the reliability of financial statements. This limitation underscores the importance of audits and internal controls.

Case Study:

A company inflates its revenue by recognizing sales prematurely to attract investors. An audit later uncovers the discrepancy, leading to legal consequences and loss of stakeholder trust.

Test your knowledge:

What steps can businesses take to minimize errors and ensure the accuracy of financial records?

7. Lack of Universality

Different countries and industries use varying accounting standards, such as GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards). These differences can make it challenging to compare financial statements across borders.

Example:

An investor analyzing companies in the U.S. and Europe may find it difficult to reconcile differences due to varying depreciation methods under GAAP and IFRS.

Actionable Tip:

Use standardized financial ratios, such as return on investment (ROI) or debt-to-equity ratio, for cross-border comparisons.

How to Mitigate the Limitations of Accounting

- Use Supplementary Tools:

Combine accounting data with other tools like SWOT analysis, market research, and customer feedback. - Regular Audits:

Conduct regular internal and external audits to ensure data accuracy and prevent fraud. - Adopt Technology:

Leverage cloud-based accounting software for real-time data access and automated processes. - Train Staff:

Educate employees on accounting best practices and ethical standards to minimize errors.

Key Takeaways

- Accounting is a valuable tool but has limitations that can impact decision-making and financial analysis.

- Factors like subjectivity, historical data reliance, and non-financial aspects require careful consideration.

- Mitigating these limitations involves adopting modern tools, ensuring compliance with standards, and incorporating non-financial metrics.

Explore our resources to deepen your understanding of accounting:

By acknowledging the limitations of accounting, you can make better-informed decisions and enhance your financial literacy. Start today!