Objectives of Cost Accounting: Unlocking Efficiency and Profitability [With PDF]

Cost accounting plays a vital role in the financial management of any organization. By analyzing costs and identifying areas for improvement, it empowers businesses to make informed decisions.

But what exactly are the objectives of cost accounting, and how can it help organizations thrive?

This article will break down these objectives and explain their significance in a clear and engaging way.

Why Are the Objectives of Cost Accounting Important?

Imagine you’re managing a manufacturing company. You know your overall revenue and expenses, but are you aware of the exact cost of producing each product? Are there inefficiencies in your operations that are silently eating away at your profits?

The objectives of cost accounting address these challenges, offering tools and insights to:

- Understand Costs: Gain a detailed view of where your money is being spent.

- Improve Efficiency: Identify and eliminate wasteful practices.

- Boost Profitability: Make data-driven decisions to enhance profits.

By focusing on these objectives, businesses can achieve a competitive edge in their industries.

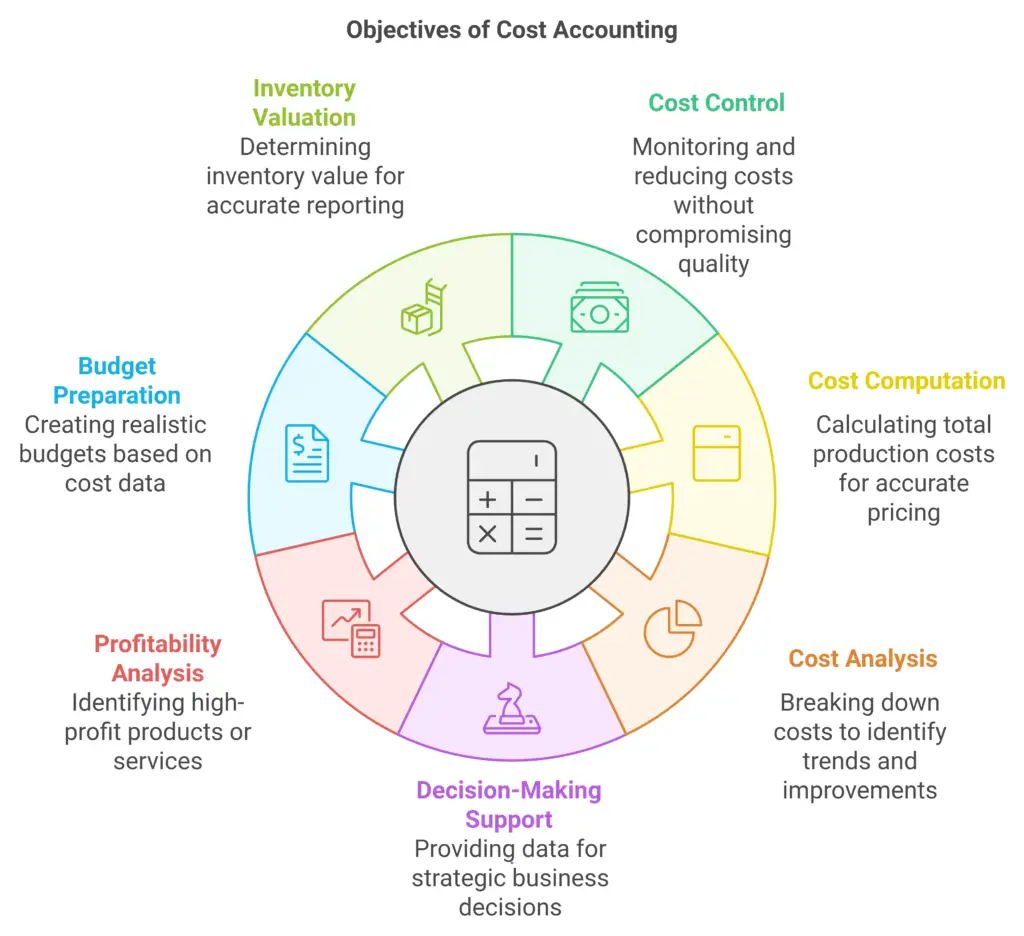

Key Objectives of Cost Accounting

1. Cost Control

One of the primary objectives of cost accounting is to control costs. Businesses can identify areas for spending reduction without compromising quality by monitoring expenditures.

Example: A clothing manufacturer tracks fabric waste during production and implements stricter guidelines to minimize material loss, saving thousands annually.

2. Cost Computation

Cost accounting calculates the total cost of producing goods or services, including direct and indirect costs. This ensures accurate pricing and financial planning.

Case Study: A bakery determines that each loaf of bread costs $1.50 to produce. Knowing this helps them set a selling price that covers costs and ensures profitability.

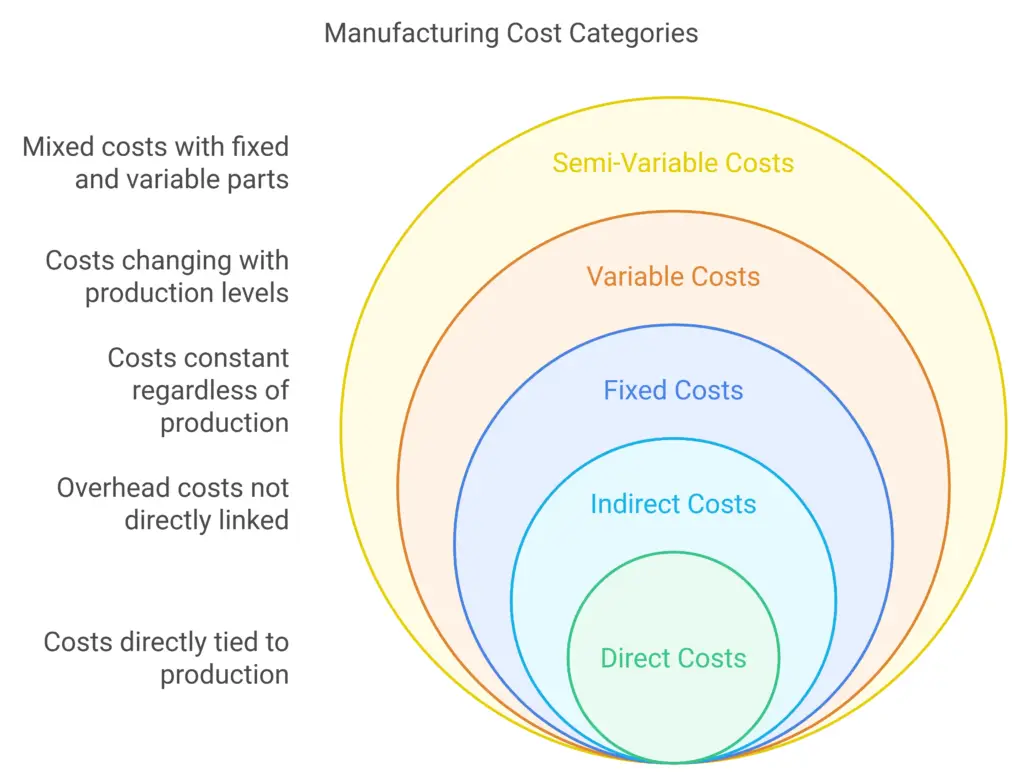

3. Cost Analysis

Breaking down costs into categories such as fixed, variable, direct, and indirect provides deeper insights. Businesses can analyze these costs to identify trends and areas for improvement.

4. Decision-Making Support

Cost accounting provides valuable data that aids in strategic decisions, such as:

- Expanding production

- Launching new products

- Outsourcing operations

Test yourself: If your company’s production costs increase by 20%, what actions would you take to maintain profitability?

5. Profitability Analysis

Not all products or services are equally profitable. Cost accounting identifies which ones generate the most profit, enabling businesses to focus on high-performing areas.

6. Budget Preparation

Accurate cost data is essential for preparing realistic budgets. Cost accounting ensures that budgets reflect actual spending patterns and forecast future needs.

Practical Tip: Use historical cost data to predict expenses and create a flexible budget that adapts to changes in demand.

7. Inventory Valuation

Cost accounting helps determine the value of inventory, ensuring accurate financial reporting and compliance with accounting standards.

Practical Example: Applying the Objectives of Cost Accounting

Let’s consider a furniture company:

- Cost Control: The company reviews its wood sourcing process and negotiates better rates with suppliers.

- Cost Computation: Each table costs $50 to produce, including materials, labor, and overhead.

- Cost Analysis: Fixed costs (factory rent) and variable costs (wood and nails) are calculated separately.

- Profitability Analysis: Dining tables generate higher margins than office desks, so the company focuses on promoting dining tables.

Challenges in Achieving Cost Accounting Objectives

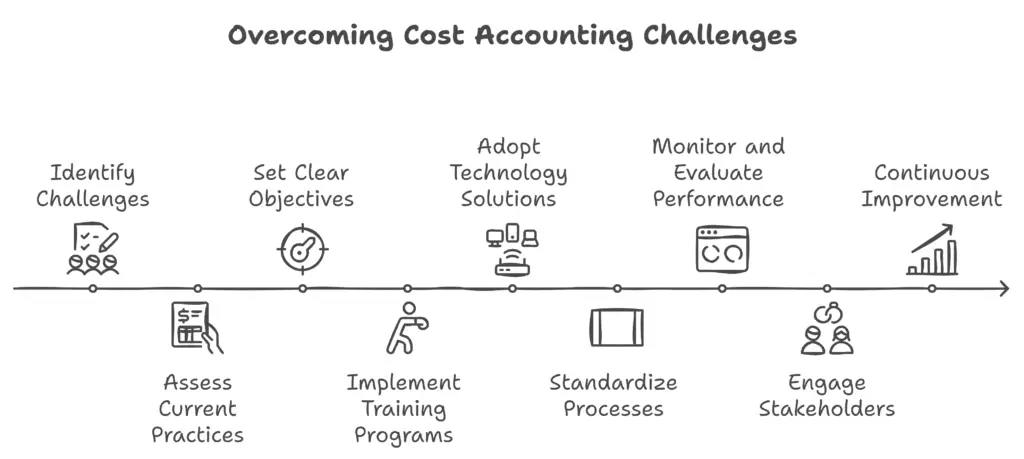

While cost accounting offers many benefits, it’s not without challenges:

- Complexity: Implementing cost accounting systems can be intricate and time-consuming.

- Data Accuracy: Errors in data collection or entry can compromise results.

- Resistance to Change: Employees may resist adopting new processes.

Overcoming Challenges

- Invest in user-friendly accounting software.

- Provide training sessions for employees.

- Regularly review and update costing methods.

Test Your Knowledge: Quiz

Key Takeaways

- Cost accounting’s objectives include cost control, analysis, and decision-making support.

- These objectives help businesses improve efficiency and profitability.

- Overcoming challenges requires the right tools and training.

Call-to-Action

Ready to explore cost accounting in more detail? Check out our comprehensive guide to cost analysis, download a free cost computation template, or test your skills with our interactive quizzes on cost accounting.

By understanding and applying the objectives of cost accounting, you can take your business’s financial management to the next level.