How Does Cost Accounting Bring Benefits To Management?

The importance of cost accounting is immense for business organizations. Cost accounting greatly aids management in making decisions on a wide range of issues by providing critical information about product costs, material usage, waste, idle time, and so on.

So, in this article, we will try to understand how cost accounting brings benefits to management.

So, let’s get started.

A Management Tool: Cost Accounting

Cost accounting provides a significant number of benefits to management. Because it gives management access to such detailed cost information, it can keep stores and inventory under control, make the organization more efficient, and cut down on waste and losses.

Information regarding costs is useful for the decision-making processes of managers operating at all levels of an organization. Managers at all levels of an organization can get a lot out of cost accounting, and these benefits show up in many different ways.

With the help of cost accounting, it is much easier to evaluate employees and give them responsibility for important tasks.

When it comes to each of these, management needs to have the ability to effectively use the data provided by cost accounts.

With this information, management can better assess their organizations’ performance.

An accurate costing system can help management in many ways, such as

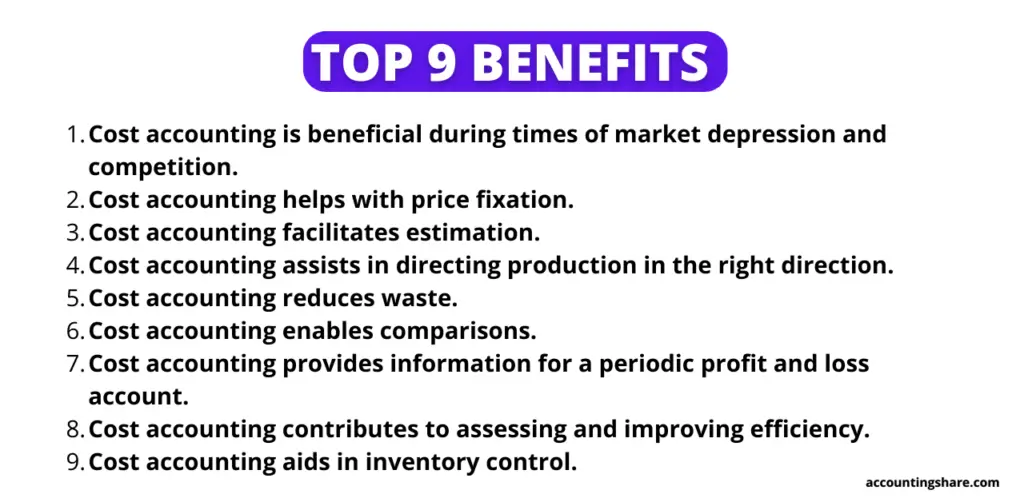

1. Cost accounting is beneficial during times of market depression and competition:

The company cannot afford to have losses that continue unchecked during times of an economic downturn. Management needs to know where there might be opportunities to save money, cut down on waste, and boost productivity.

In order to survive and continue to grow, the organization must fight. Before beginning any plan to reduce prices, management should be aware of the true cost of their products.

An effective costing system makes this possible.

2. Cost accounting helps with price fixation:

The cost to the producer does matter a lot, even though the law of supply and demand largely determines the price of the good.

If the producer is able to set or change the price, he can look at his costing records to help him decide what to do.

3. Cost accounting facilitates estimation:

When you keep excellent cost records, you have a solid foundation for making accurate estimates and bids.

This makes it much easier for management to make decisions regarding various topics.

4. Cost accounting assists in directing production in the right direction:

With the assistance of accurate cost data, management is able to differentiate between activities that are profitable and those that are not profitable.

They are able to maximize profits by concentrating on profitable operations and getting rid of the ones that are not profitable.

5. Cost accounting reduces waste:

Cost accounting’s focus on providing a thorough breakdown of costs makes it possible to investigate various types of losses or waste, which can help the organization reduce its waste production.

The goal of cost accounting is to keep costs under control so that the organization doesn’t lose money and to reduce waste by looking at the different kinds of waste.

6. Cost accounting enables comparisons:

Keeping excellent cost records gives managers a wide range of cost data to compare, which helps them make plans for what to do next.

Cost accounting lets you compare the different kinds and amounts of money spent on different organizational activities, as well as the total costs incurred by the organization and all of its divisions, departments, and plants.

7. Cost accounting provides information for a periodic profit and loss account:

In order to properly prepare a periodic profit and loss account, management needs access to accurate cost information.

Adequate cost records give the management the information they may need to prepare the balance sheet and profit and loss account at the intervals they may desire.

8. Cost accounting contributes to assessing and improving efficiency:

If we carefully examine the various production operations, we will disclose losses due to material waste, employee idle time, poor supervision, and other factors.

Numerous methods exist for controlling costs and measuring and improving efficiency.

Management can use a wealth of information from cost accounting to evaluate and improve operational efficiency. This includes information about products, waste, idle time, material use, employee productivity, and so on.

9. Cost accounting assists in inventory control:

Cost accounting provides the management with the control they need over the stock of raw materials, work-in-progress, and finished goods.

Cost accounting helps management cut costs and boost productivity in the inventory control process.

It achieves this by mandating the establishment of standards and rigorous oversight of material usage.

By the end of this article, I hope you have a clear understanding of the benefits that cost accounting brings to management.

If you have any questions or concerns, please let us know in the comments below.

You can also read: