Accounting Equation-Definition, Example, Elements, Application, and Effects [Notes with PDF]

The accounting equation is the foundation of accounting education. You must understand the accounting equation if you want to learn the fundamentals of accounting.

So, in this article, we’ll learn about the accounting equation, including its definition, example, application, elements, effects on transactions, and other details.

So let’s get started.

What is The Accounting Equation?

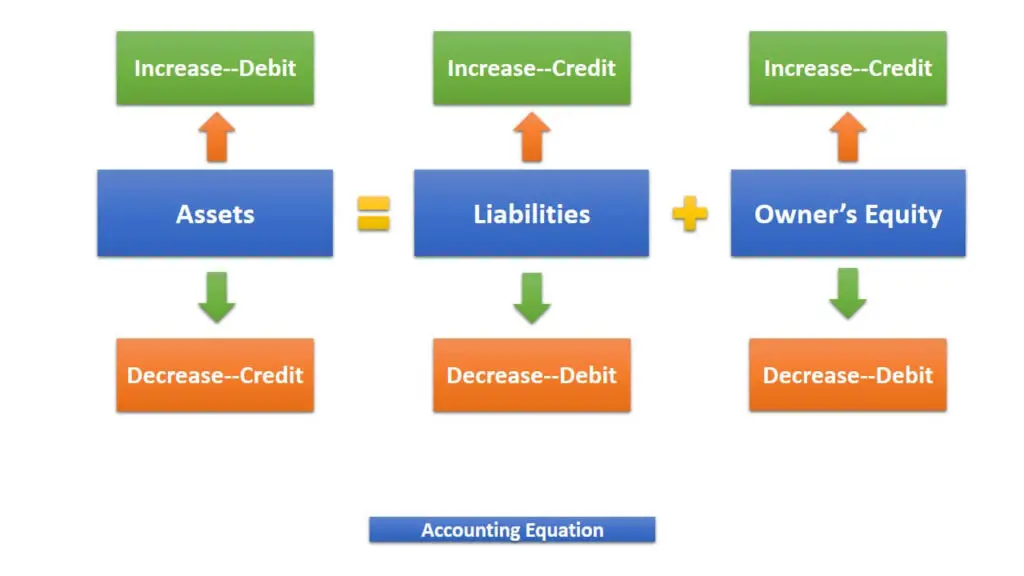

In a double-entry accounting system, every transaction has two sides. The first one is debit, and the second one is credit.

On the basis of this dual nature of transactions, modern accountants have developed a mathematical formula that is referred to as the accounting equation.

An accounting equation is a mathematical formula that illustrates how a company’s total assets and total liabilities relate to one another. In other words, an accounting equation is a mathematical expression.

The relationship of assets, liabilities, and owner’s equity can be expressed as an equation as follows: Assets = Liabilities + Owners’ equity

J. J. Weygandt, DE Keiso, PD Kimmel

The accounting equation describes the relationship that exists between the assets and liabilities of a company, in addition to the owner’s equity. The equation is sometimes referred to as the balance sheet equation.

This equation is used to perform all of the tasks that are associated with using a double-entry accounting system.

Fundamental Accounting Equation: A=E

Here,

A = Assets

E = Equity

So the fundamental accounting equation is Assets = Equity

Basic Accounting Equation: A=L+OE

Here,

A = Assets

L = Liabilities

OE = Owner’s Equity

So the basic accounting equation is Assets= Liabilities + Owner’s Equity

Expanded Accounting Equation: A=L+(C+R-E-D)

Here,

A=Assets

L = Liabilities

C = Capital

R = Revenue

E = Expense

D = Drawings

So the expanded accounting equation is Assets= Liabilities + (Capital+ Revenue-Expenses-Drawings)

Example of Accounting Equation

The relationship between assets, liabilities, and owner’s equity can be expressed as an equation, as will be shown in the following example.

What a company owns and what it owes are the two fundamental components that make up a business.

A company’s resources that it owns are referred to as its assets. For example, ABC & Co. has total assets of approximately $17.5 billion.

The rights or claims that can be made against these resources are referred to as liabilities and owner’s equity.

Thus, ABC & Co. has $17.5 billion of claims against its $17.5 billion of assets.

Liabilities are the claims made by creditors, who are individuals or organizations to whom the company owes money. Claims of owners are called “owner’s equity.”

ABC & Co. has liabilities of $3.2 billion and owners’ equity of $14.3 billion.

| Assets | = | Liabilities | + | Owner’s Equity |

| $17.5 | = | $3.2 | + | $14.3 |

Application of the Accounting Equation

The accounting equation is applicable to all economic entities, irrespective of their size, type of business, or organizational structures for conducting business.

It is applicable to businesses of all sizes, from sole proprietorships like neighborhood grocery stores to multinational conglomerates like Google.

The equation serves as the underlying structure for recording and summarizing the events that occur in the economy.

Elements of the Accounting Equation

The three elements of the accounting equation are as follows:

- Assets

- Liabilities

- Owner’s equity

Let’s take a look at the accounting equation’s components in a little more detail.

Assets:

The resources that a company owns are its assets. In order to carry out its operations, such as production and sales, the company uses its assets.

One quality that is shared by all assets is the ability to continue providing services or benefits into the foreseeable future. This opportunity to provide a service or realize potential economic gain for the company will ultimately result in cash inflows (also known as receipts).

For example, cash, inventory, furniture, machinery, buildings, goodwill, etc.

Liabilities:

Liabilities are claims made against assets, or current debts and obligations. Borrowing money and making purchases on credit are common practices for companies of every size.

These various forms of economic activity result in a wide range of payables.

For example, accounts payable, notes payable, bank loans, salaries payable, etc.

Owner’s Equity:

The owner’s equity is the claim to ownership over all assets. It is determined by subtracting all assets from all liabilities.

Creditors and owners can both stake a claim on the assets of a company. In order to determine what belongs to the owners, we first take the claims that the creditors have (which are liabilities) and subtract those from the assets. The amount that is left over is what is known as the owner’s equity in the assets.

The term “residual equity” is frequently used to refer to the owner’s equity. This is due to the fact that ownership claims have to be paid after creditor claims.

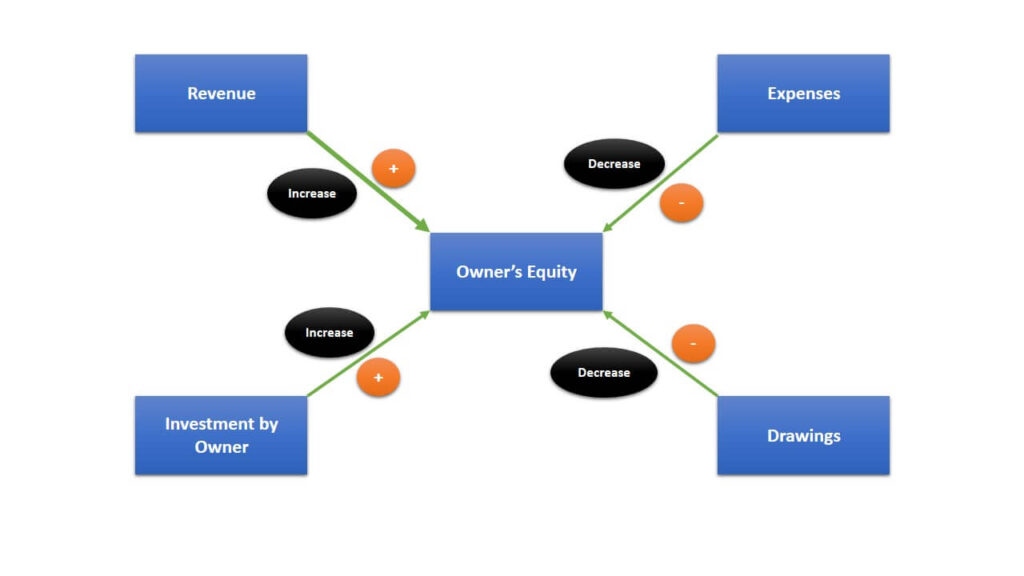

There are primarily four elements that have an effect on the equity of the owner. These are-

- Investment by owner

- Revenues

- Expenses

- Drawings

Investment by owner:

The assets that an owner contributes to a business are known as investments. These investments contribute to an increase in the owner’s equity.

Investment by an owner is recorded under the heading “owner’s capital.”

Revenues:

Revenues are the total increase in an owner’s equity as a result of commercial activities carried out with the intention of making money.

These activities are typically carried out with the purpose of earning money.

The most common sources of revenue are the sale of goods and services, the leasing of real estate, the provision of financial loans, commissions, fees, interest, royalties, dividends, and rent.

Typically, an increase in revenues will result in an increase in the value of an owner’s equity. They might be known by a number of different names and come from a variety of different places, depending on the kind of business they are in.

Drawings:

An owner has the right to take money or other assets for personal use. We make use of a separate category that we refer to as “drawings” in order to compute the total amount of withdrawals for each accounting period. Drawings reduce the owner’s equity.

Drawings are recorded under the heading “owner’s drawings.”

Expenses:

Expenses are defined as the amount of money spent on the acquisition of goods or services that are used to produce revenue. They are deductions from an owner’s equity that are caused by the operation of a business.

For example, purchases, wages, salaries, electricity bills, interest expenses, depreciation, taxes, and so on.

| OE Increase | OE Decrease |

| If services are performed or increased | If expenses increase |

| If capital is invested | If revenue decreases |

| If expenses decrease | If the owner withdraws |

| If profit or net income occurs |

The transaction that takes place as a result of an event can bring about any of the following changes to the components of the accounting equation.

- A transaction may result in an increase in assets, and an increase in liabilities, or equity.

- Without affecting the other side of the equation, it may see an increase in one asset and a corresponding decrease in another asset.

- A decrease in one asset might be accompanied by a corresponding decrease in liability or equity.

- It may decrease one liability or equity while increasing another liability or equity.

Accounting Equation’s Effects on Business Transactions

Accounting professionals record the economic activities of a business as transactions (business transactions).

There are two types of transactions: internal and external.

The economic activities that take place between the company and an outside enterprise are referred to as “external transactions.”

The monthly payment of rent to a landlord, the purchase of equipment from a supplier, and the sale of goods to customers are all examples of external transactions.

Internal transactions are economic activities that take place solely within a single organization.

For example, the use of raw materials and packaging materials are both considered to be part of internal transactions.

There are many activities that are not considered to be business transactions that are carried out by businesses.

Filling out job applications, responding to emails, interacting with customers, and placing product orders are all examples of this type of work.

There is a possibility that some of these activities will lead to business transactions. For example, the suppliers will deliver the ordered goods, and the workers will be paid for their efforts.

The company must analyze each event to determine whether or not it has an effect on the variables that make up the accounting equation. In that case, the company will make sure to record the transaction.

There must be two effects of each transaction on the accounting equation. To illustrate, if an asset increases, there must be a corresponding

- decrease in another asset,

- increase in a particular liability, or

- increase in owner equity.

There may be an effect on two or more of these things. For example, if one asset increases by $5,000, it’s possible that another asset will decrease by $3,000, and liabilities will increase by $2,000 simultaneously.

Any change to a liability or ownership claim necessitates the performance of analysis with the same structure.

Transaction Analysis:

We will examine the operations of “ABC Enterprise” to show how to analyze transactions in terms of the accounting equation.

During ABC Enterprise’s first complete month of operations, the following business transactions took place.

- Jun 1 Invested $20,000 in his business.

- Jun 3 Goods purchased from the vendors for cash 12,000

- Jun 6 Furniture purchase on credit worth $16,000

- Jun 11 Goods sold to the customers for cash $9,000.

- Jun 16 Paid salary to the office staff $4,000.

- Jun 22 Loan taken from the bank $30,000.

- Jun 25 Goods sold to the clients on credit $5,000.

- Jun 28 Dues for furniture purchase paid $8,000.

- Jun 30 Paid the rent for the month of May $2,000.

The impact of transactions on the accounting equation is shown below:

Transaction-01: Invested $20,000 in his business.

Basic analysis:

This transaction results in an equal increase in assets and owner’s equity by $20,000.

Effect on the accounting equation:

| Assets | = | Liabilities | + | Owner’s Equity |

| Cash | Capital | |||

| +20,000 | = | 0 | + | +20,000 |

Transaction-02: Goods purchased from the vendors for cash 12,000

Basic analysis:

Due to the purchase of goods, the asset (cash) decreases by $12,000, and the owner’s equity (expenses) decreases by $12,000.

Effect on the accounting equation:

| Assets | = | Liabilities | + | Owner’s Equity |

| Cash | Expense | |||

| -12,000 | = | 0 | + | -12,000 |

Transaction-03: Furniture purchase on credit worth $16,000

Basic analysis:

As a result of this transaction, the liability (accounts payable) and asset (furniture) both increased by $16,000.

Effect on the accounting equation:

| Assets | = | Liabilities | + | Owner’s Equity |

| Furniture | Accounts Payable | |||

| +16,000 | = | +16,000 | + | 0 |

Transaction-04: Goods sold to the customers for cash $9,000.

Basic analysis:

As a result of this transaction, the asset (cash) and owner’s equity (revenues) both increased by $9,000.

Effect on the accounting equation:

| Assets | = | Liabilities | + | Owner’s Equity |

| Cash | Revenue | |||

| +9,000 | = | 0 | + | +9,000 |

Transaction-05: Paid salary to the office staff $4,000.

Basic analysis:

As a result of this transaction, the asset (cash) and owner’s equity (expenses) both decreased by $4,000.

Effect on the accounting equation:

| Assets | = | Liabilities | + | Owner’s Equity |

| Cash | Expense | |||

| -4,000 | = | 0 | + | -4,000 |

Transaction-06: The loan was taken from the bank $30,000.

Basic analysis:

As a result of this transaction, the asset (the bank) and the liability (the bank loan) both increased by $30,000.

Effect on the accounting equation:

| Assets | = | Liabilities | + | Owner’s Equity |

| Bank | Bank Loan | |||

| +30,000 | = | +30,000 | + | 0 |

Transaction-07: Goods sold to the customers on the credit of $5,000.

Basic analysis:

As a result of this transaction, the asset (accounts receivable) and the owner’s equity (revenues) both increased by $5,000.

Effect on the accounting equation:

| Assets | = | Liabilities | + | Owner’s Equity |

| Accounts Receivable | Revenue | |||

| +5,000 | = | 0 | + | +5,000 |

Transaction-08: Dues for furniture purchase paid $8,000.

Basic analysis:

As a result of this transaction, the asset (cash) and the liability (accounts payable) both decreased by $8,000.

Effect on the accounting equation:

| Assets | = | Liabilities | + | Owner’s Equity |

| Cash | Accounts Payable | |||

| -8,000 | = | -8,000 | + | 0 |

Transaction-09: Paid the rent for the month of May $2,000.

Basic analysis:

As a result of this transaction, the asset (cash) and the owner’s equity (expenses) both decreased by $2,000.

Effect on the accounting equation:

| Assets | = | Liabilities | + | Owner’s Equity |

| Cash | Expense | |||

| -2,000 | = | 0 | + | -2,000 |

Summary of Transaction:

| Transaction | Assets | = | Liabilities | + | Owner’s Equity |

| 1 | +20,000 | = | + | +20,000 | |

| 2 | -12,000 | = | + | -12,000 | |

| 3 | +16,000 | = | +16,000 | + | |

| 4 | +9,000 | = | + | +9,000 | |

| 5 | -4,000 | = | + | -4,000 | |

| 6 | +30,000 | = | +30,000 | ||

| 7 | +5,000 | = | + | +5,000 | |

| 8 | -8,000 | = | -8,000 | + | |

| 9 | -2,000 | = | + | -2,000 | |

| Check | 54,000 | = | 38,000 | + | 16,000 |

I hope by the end of this article you have a clear understanding of the accounting equation. If you have any doubts or questions, please leave a comment.

You can also read: