The Ultimate Guide to Becoming a Good Accountant

If you are interested in becoming a good accountant, there are a few things that you absolutely need to be aware of.

Even if an accountant has a solid understanding of taxes, budgeting, double entry systems, accounting equations, financial statements, ratios, and other forms of financial documentation, this may not have the effect that is desired if the accountant is unable to present himself or herself in front of clients, analyze the financial and tax data, or utilize the accounting and tax applications.

In this article, we will go over some of the most important skills that a good accountant needs to have in order to do their job effectively.

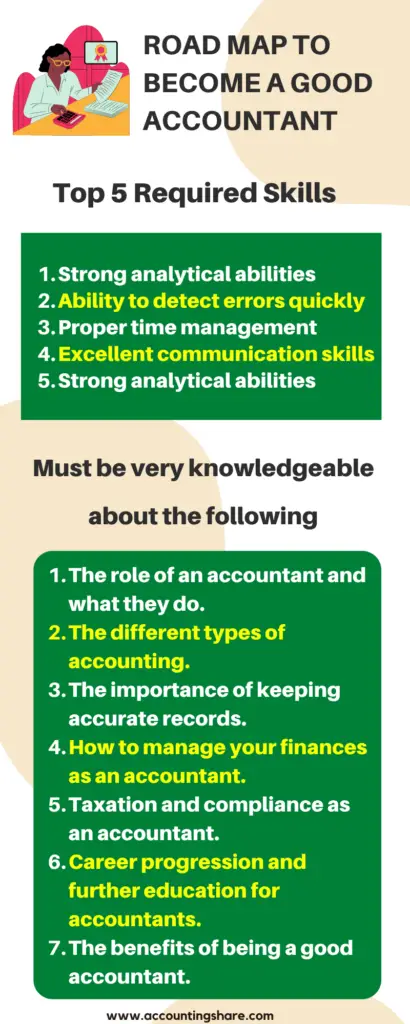

Qualifications and Skills Required to Become a Good Accountant

To become a good accountant, you need to meet certain requirements and have certain skills.

Excellent in math:

To begin, a competent accountant must have a solid grasp of mathematical concepts. They must be able to do the math and find answers to problems quickly and accurately.

A sign of good accountant is someone who can perform calculations in a quick and efficient manner.

Ability to detect errors quickly:

Second, they need to have a keen eye for the smallest of particulars. They need to have the ability to quickly identify errors and blunders.

The most skilled accountants are able to scan an analysis report and determine, at a glance, whether or not the facts and figures are consistent with one another.

Proper time management:

Thirdly, they need to have a good grasp of how to manage their time. They need to be able to multitask effectively and work within strict time constraints.

The tax season is the busiest time of year for accountants, and they are under the most pressure to meet their client’s deadlines.

This is when the ability to manage one’s time effectively is most valuable.

Excellent communication skills:

Fourth, they should have strong communication skills. The communication of complicated information in the clearest and most understandable manner is essential for accountants.

They should be able to explain financial ideas in a way that is clear and easy to understand.

Strong analytical abilities:

The last requirement for becoming an accountant is that one must have strong analytical skills. The size of the client’s company and the sector in which they operate both play a role in determining the nature of their financial requirements.

Therefore, an accountant needs to have strong analytical skills to be able to deduce key insights from the tax data of previous years, both corporate and personal, so that they can provide optimal strategies depending on the needs of their clients.

A good accountant also needs to know a lot about the following things:

- The role of an accountant and what they do.

- The different types of accounting.

- The importance of keeping accurate records.

- How to manage your finances as an accountant.

- Taxation and compliance as an accountant.

- Career progression and further education for accountants.

- The benefits of being a good accountant.

Now, we’ll try to talk more specifically about the things we’ve already talked about.

The Role of an Accountant and What They Do

An accountant is a trained professional who provides assistance to businesses, as well as individuals, in maintaining accurate financial records.

They work with financial records, ensuring that the records are accurate and that they conform to the requirements set forth by the relevant authorities. In addition to this, accountants give advice on various tax and financial planning strategies.

The majority of accountants hold a bachelor’s degree in accounting or a field closely related to accounting. Many accountant jobs require certification, such as the Certified Public Accountant (CPA) designation.

The Different Types of Accounting

There are three primary branches of accounting, namely financial, management, and tax accounting. Each category emphasizes a different set of topics.

- Financial Accounting: This type of accounting focuses on the financial statements that are sent to stockholders and creditors. Financial accounting is the most common kind of accounting. As part of making financial statements, transactions need to be recorded, put into categories, and summed up.

- Management Accounting: Management accounting is a subfield of accounting that focuses on the process of disseminating information to managers in order to assist them in the decision-making process regarding the distribution of available resources. Creating budgets, making forecasts, and conducting variance analyses are all part of this process.

- Tax Accounting: Tax accounting is a subfield of accounting that focuses on the fiscal repercussions of business transactions. It consists of preparing tax returns as well as planning for potential tax liabilities.

The Importance of Keeping Accurate Records

Maintaining accurate records is one of the most important aspects of being a good accountant. It would be impossible to track finances and make informed decisions about where to allocate resources without accurate records.

There are several methods for keeping records, but regardless of which method is used, it is essential to be consistent and organized.

Using accounting software such as QuickBooks or Xero is one method of keeping records. Users can use these programs to keep track of their income and expenses, generate reports, and create invoices and other documents.

Another option for keeping records is to use a spreadsheet program such as Microsoft Excel. Spreadsheets can be customized to track specific data and be used to generate reports.

It is important to keep accurate records, regardless of the method used. This includes keeping track of all transactions, receipts, and invoices, as well as tracking payments.

By keeping accurate records, accountants can make sure that money is managed well and that resources are used in the best way possible.

How to Manage Your Finances As an Accountant

An accountant must possess a wide range of skills in order to be successful. One of the most important is their financial management ability.

A good accountant will always keep track of their income and expenses in order to stay on budget. They will also save up for unexpected expenses, such as a new computer or a trip to a conference.

Furthermore, a good accountant is constantly looking for ways to improve their financial situation. They may spend money on new software to help them do their jobs better, or they may enroll in courses to learn more about financial management.

Taxation and Compliance as an Accountant

Your clients’ taxation and regulatory compliance will fall under your purview as an accountant when you handle their financial matters. This includes preparing and filing tax returns for clients, as well as ensuring that clients are in compliance with applicable tax laws.

You will need to have a solid understanding of tax law and the ability to apply that knowledge to the specific aspects of each client’s financial situation.

Career Progression and Further Education for Accountants

There is a lot of competition for jobs, and in order to get hired as an accountant, you will either need a relevant degree, a postgraduate qualification, or a significant amount of experience.

If you want to advance to more senior positions, you absolutely need to have prior professional experience. Graduate programs in accounting and finance are offered by the majority of accounting firms as well as large businesses; these programs are an excellent way to get your foot in the door.

The majority of these programs give participants the opportunity to continue their education and earn professional credentials while they are employed.

For example, the main professional accountancy bodies in the UK are the Association of Certified Chartered Accountants (ACCA), the Institute of Chartered Accountants in England and Wales (ICAEW), and the Chartered Institute of Management Accountants (CIMA).

These organizations provide organized learning programs that lead to a variety of professional qualifications.

The Benefits of Being a Good Accountant

An accountant is a person who works with financial records and is responsible for ensuring that those records are accurate and in accordance with applicable laws and regulations. Many accountants also offer guidance on financial planning and tax preparation.

Being a skilled accountant comes with a number of important advantages. The possibility of making a lot of money is probably the aspect that jumps out the most.

The Bureau of Labor Statistics reports that the average annual salary for accountants in 2018 was $69,350, while those in the top 10 percent earned more than $122,840.

However, economic success is not everything in life. Accountants who are skilled in their craft also benefit from having stable employment and the opportunity to serve a broad range of clients.

They typically have more adaptable work hours and are able to perform their jobs from the comfort of their own homes or from any location with internet access.

Accounting is a field that is constantly evolving, which means that there is always something new to learn within the discipline.

If you’re interested in a career in accounting, here are a few tips to get you started:

- Earn a degree in accounting or a field that is closely related to it. Even though it is possible to work as an accountant without having a degree, the majority of employers look for candidates who have earned at least a bachelor’s degree in accounting or a field that is closely related to accounting, such as finance or business administration.

- Take obtaining a certificate into consideration. The Certified Public Accountant (CPA) designation is one of several professional certifications open to accountants. Other certifications are also available. Getting a certification can help you show your knowledge and commitment to your chosen field in a more convincing way. It can also make you eligible for better-paying jobs and more job openings overall.

- Maintain awareness of the most recent changes to tax regulations and laws. If you want to be successful in this area, it is essential to keep up to date on the most recent developments, as the tax code is in a state of constant flux. Signing up for email newsletters or magazine subscriptions that cover topics like accounting and taxes is one way to accomplish this goal. Another option is to keep your membership in professional organizations like the American Institute of Certified Public Accountants (AICPA).

I really hope that by the time you reach the end of this article, you will have a very good comprehension of how to become a good accountant.

This article is an attempt to cover everything that an accountant does, what qualities are required, what role an accountant plays in the business, what degree is required, the benefits of being a good accountant, and many other things that are necessary to become a good accountant.

I hope that you find this article helpful. I believe that it will assist you in developing into a skilled accountant.

You can also read: