Top 16 Users of Accounting Information [With PDF]

Do you want to know who the top users of accounting Information are? Don’t worry, today we will learn the top 16 users of accounting information.

Before we start, first we know what is accounting information? And what are the sources of accounting information.

What is Accounting Information?

In a general sense, information refers to data gathered for the purpose of conducting research on a particular subject.

Accounting information includes both information and data on the subject of accounting, such as the amount of money owed, the amount due, the amount of income tax, the amount of goods purchased, and the amount of goods sold.

The owner can know about the financial status of his organization by using these accounting data. Investors may know about the position of their investments in the future.

The income tax authorities will figure out how much money will be received from various sectors for income tax by looking at these various account information.

Overall, accounting data allows the government to make informed decisions on how to operate the state.

Since accounting is an information system. Accounting information is constantly changing through research, practice, and practical application.

As a result, accounting is playing a dynamic role in the management of individuals, society, and the state through the discovery of new theories and information.

As a result, the number of users of accounting information is increasing day by day.

What are the Sources of Accounting Information?

These are the sources of accounting information

- Income statement

- Statement of financial condition

- Cash flow statement etc.

Who are the Top 16 Users of Accounting Information?

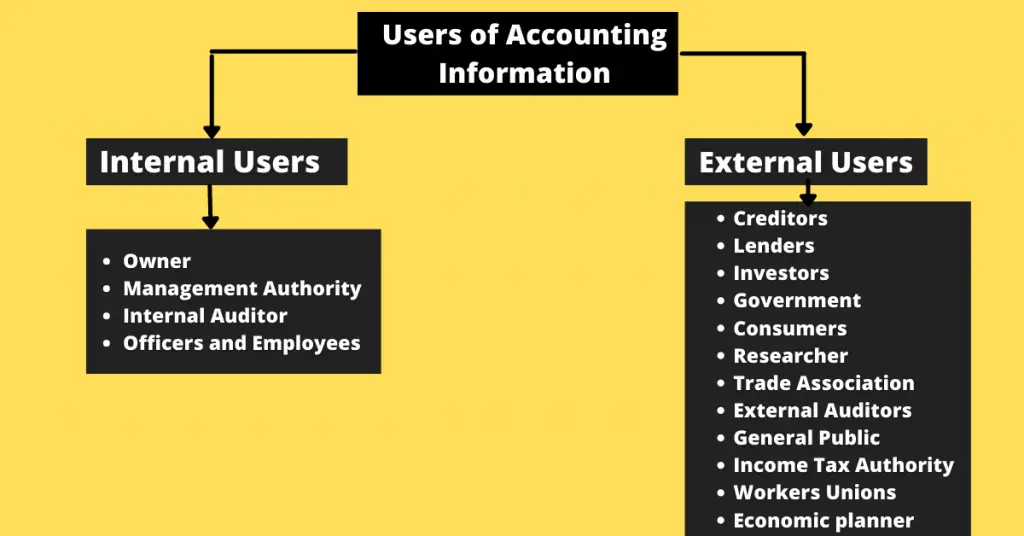

There are two types of accounting information users which are as follows:

- Internal Users

- External Users

The following is a complete breakdown of account users and their reasons for using them:

Top 4 Internal Users

The top 4 internal users of accounting information are as follows:

1.Owner:

The owner is an important internal part of the business organization. He has invested in business capital.

It is natural that he will be interested to know all the information of the business organization.

He is interested in various information such as whether his invested capital is safe in the business, how much profit is being earned from the investment, present financial condition and future activities of the organization, financial viability of the organization, business expansion plan, etc.

2. Management Authority:

The success of a business organization depends a lot on the efficient management of the management authority.

Management authorities are successful only when they can formulate the right plan. Financial planning depends on accurate and reliable information.

When and how much product will be bought or sold, how much money will be spent on which source, and how much money will be derived from which source, management must gather information in order to make different plans.

3. Internal Auditor:

The company appoints an internal auditor to ensure that the business organization’s operations are carried out according to the plan.

The internal auditor gathers different information from the company in order to determine if work is being performed correctly in all divisions.

He compared the actual results obtained with the targets set in the previous plan, revealing issues with the plan’s efficacy and realistic application.

They advise taking the appropriate measures to resolve any problem.

4. Officers and employees:

Officers and employees are also important internal users of accounting information in the company.

They can learn from the business organizations numerous data that in order for the organization and their own growth to extend the reach of their work, in some cases, they have the ability to improve their work, and in other cases, they need their own training.

They can also talk to the owners about their remuneration and other benefits depending on the organization’s information and argue their points.

Top 12 External Users

Top 12 external users of accounting information are as follows:

1.Creditors:

Creditors usually lend goods to the institution. They collect various information about the organization before delivering the product on credit.

They will not want to lend goods until they are sure that they will get their money back on time.

For this reason, they sell the products on credit by checking the information of the financial well-being of the business organization, payment conditions, ordering period of the product, etc.

2. Lenders:

Loans are a common way for businesses to raise capital. Lenders will not repay the loan until they are confident that the principal and interest will be repaid on time.

As a result, lending institutions make loans by gathering and analyzing information about the sector in which the business will invest the money, when and how the money will be returned from the investment, the current organization’s financial well-being, current debt management, and so on.

3. Government:

The country’s government collects information from businesses whenever it needs it.

The government collects various information to determine whether the company is operating in accordance with the country’s laws, paying taxes, VAT, and other taxes on time, contributing to the country’s socio-economic development, and so on.

4. Investors:

Investors will always want to invest in a profitable industry so that their money is not at risk.

So they invest by calculating to ensure that the organization will use the money received from them in any sector, what its future profitability will be, how much from the investment will be made, and how long the profit will be made.

As a result, in order to resolve these issues, investors gather and analyze various business organization data.

5. Consumers:

A company’s most valuable asset is its customers.. Essentially, all of the organization’s activities revolve around these customers.

They must be satisfied by providing a variety of facilities. Because if the consumers are dissatisfied for any reason, the organization’s main activities will be disrupted.

These customers want to know about the quality of the products that the company produces, whether there is a balance between price and quality, whether a consistent supply of products is available, and so on.

6. Researcher:

Trade and commerce play an important role in the country’s socio-economic development. Researchers are investigating how much business is contributing to this.

To study this topic, researchers will need a wide range of information on business organizations.

The findings of the researchers’ research can be used by the business organization, the government, and other organizations as needed.

7. Trade Association:

The Trade Association’s main function is to create a conducive environment for business and trade, as well as to encourage better relationships between businesses and the parties involved in the organization.

It protects the interests of all sections of society. In this case, the merchant association makes an important contribution to the development of trade and commerce, the development of the country and its people, the creation of jobs, the maintenance of good working relations, and so on.

They require various information about their business organization in order to do these things beautifully and properly.

8. External Auditors:

In many cases, as required by the owner, in accordance with the country’s prevailing laws, or in special circumstances, the external auditor examines and verifies the organization’s accounts and determines the accuracy, error, and fraud.

Occasionally, they will even offer various pieces of advice about the organization.

The auditor’s tasks necessarily require a wide range of organizational information.

9. General Public:

The general public is interested in the progress of the business. They want to know what interests the organization is protecting for the country and the people, as well as how the organization’s activities affect the natural environment, social environment, and economic environment.

They are interested in learning about the various activities of the business organization in order to understand these issues.

10. Income Tax Authority:

Every business organization’s income is taxed and collected by the Income Tax Authority.

They need to know if they are paying their taxes on time and in accordance with the rules of the establishment.

And it is for this reason that income tax authorities are interested in tax-related information.

11.Workers ‘ Unions:

Workers’ unions typically negotiate with the government and owners to assert workers’ rights. Workers’ unions present the various information of business organizations to the owner or the government in order to discuss these issues, and they present their demands logically.

This requires accounting information.

12. Economic Planner:

Economic development requires a well-thought-out strategic plan. And this plan necessitates accurate accounting data from businesses.

And economic planners use all of this data to create the best economic development strategy.

Conclusion:

I believe you now understand who the top 16 users of accounting information are? and how they use it? If you have any questions or want to learn more about accounting information users, please leave a comment.

You can also read: