What is Trial Balance? [With PDF]

A trial balance is a statement prepared on a particular date with the ledger account balances to test the arithmetical accuracy of the ledger accounts and facilitate the preparation of financial statements. It is to be noted that the trial balance is not an account; it is a statement.

A trial balance is a schedule or a list of balances, both debit and credit, extracted from the accounts in the ledger and including the cash and bank balances from the cash book.

R.N. Carter

A trial balance is a list of all the accounts along with their current balances. Although a trial balance can be prepared at any time, it is best to do so at the end of the reporting period, that is, at the end of the month, quarter, or year, in order to confirm that all of the accounts are accurately listed before the financial statements are prepared.

The trial balance displays the accounts in the same order as they appear in the ledger, with credit balances on the right and debit balances on the left column. The totals in the two columns should agree, regardless of how it is prepared.

The primary purpose of trial balances is to prove the mathematical equality of debits and credits after posting.

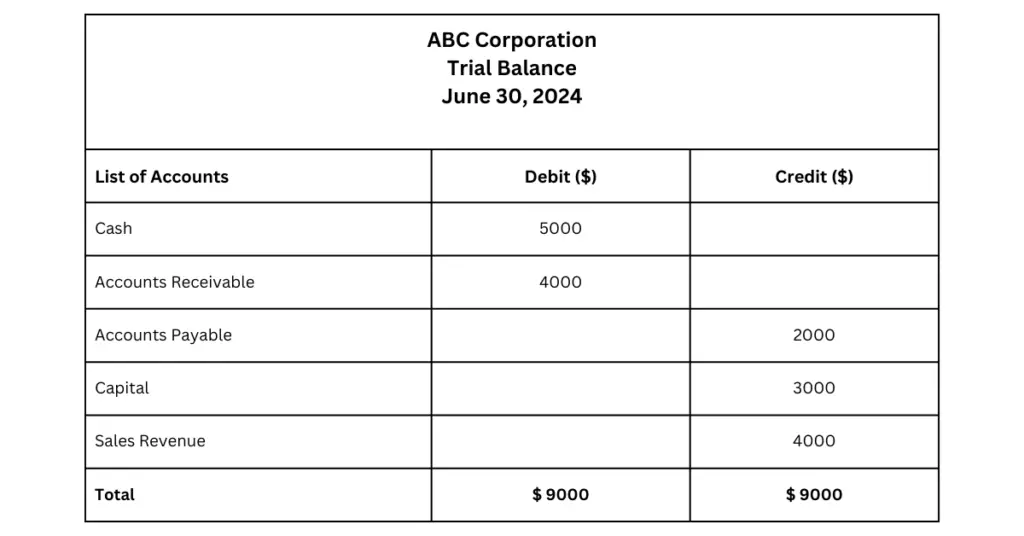

Example of a Trial Balance:

The following is an example of a trial balance:

Key Notes:

- The trial balance is a statement showing debit and credit balances after posting accounts in the ledger.

- It can be prepared by listing each account and entering the totals of the debit and credit sides in separate columns.

- The totals of the two columns should agree to indicate arithmetic accuracy.

- Trial balances can be prepared at any time, but it is preferable to prepare at the end of the reporting period to ensure arithmetic accuracy before financial statement preparation.

- The trial balance is a statement, not an account.

You can also read:

![7 Important Limitations of Trial Balance [With PDF]](https://accountingshare.com/wp-content/uploads/2024/06/7-important-limitations-of-trial-balance-768x402.png)