How to Become a CPA: Your Complete Guide to Success

Introduction: Why Becoming a CPA Matters

Are you considering a career in accounting but wondering how to elevate yourself above the competition? Becoming a Certified Public Accountant (CPA) is one of the most prestigious milestones in the accounting profession.

A CPA license not only validates your expertise but also provides access to higher salaries, leadership roles, and enhanced career opportunities. However, many aspiring CPAs find themselves asking, “Where do I start?”

This guide will walk you through the actionable steps to becoming a CPA, breaking down the process into manageable phases.

Whether you’re a student or a professional, this roadmap will help you achieve your goal efficiently and confidently.

What Is a CPA?

A Certified Public Accountant (CPA) is a licensed accounting professional who specializes in financial analysis, tax preparation, auditing, and consulting.

CPAs are highly sought after for their ability to provide strategic insights and ensure compliance with financial regulations.

Why Should You Become a CPA?

- Career Growth: CPAs often land higher-paying jobs with greater responsibilities.

- Job Security: The demand for CPAs remains consistent, even during economic downturns.

- Versatility: CPAs work across various industries, including finance, healthcare, and technology.

What specific benefits of becoming a CPA align with your career aspirations?

Step 1: Meet the Educational Requirements

The first step to becoming a CPA is meeting the educational prerequisites. Most jurisdictions require candidates to have at least 150 semester hours of college credit, which typically includes a bachelor’s degree in accounting or a related field.

Key Tips:

- Choose the Right Program: Enroll in an accredited college or university offering courses in accounting, finance, and business law.

- Consider a Master’s Degree: Many students pursue a master’s in accounting to meet the 150-hour requirement.

- Plan Ahead: Take courses that align with CPA exam topics, such as auditing, taxation, and financial accounting.

Downloadable Resources: CPA Education Checklist

Step 2: Gain Relevant Work Experience

Before you can become a licensed CPA, most states require 1-2 years of professional work experience under a licensed CPA’s supervision.

How to Get Started:

- Internships: Secure internships during your undergraduate or graduate studies to gain hands-on experience.

- Entry-Level Jobs: Start as a staff accountant or in roles such as tax preparer or auditor.

- Networking: Join accounting associations to connect with licensed CPAs who can guide and mentor you.

Example:

Maria, a recent accounting graduate, completed a year-long internship at a mid-sized accounting firm. Her supervisor, a licensed CPA, helped her meet the experience requirement while providing valuable career advice.

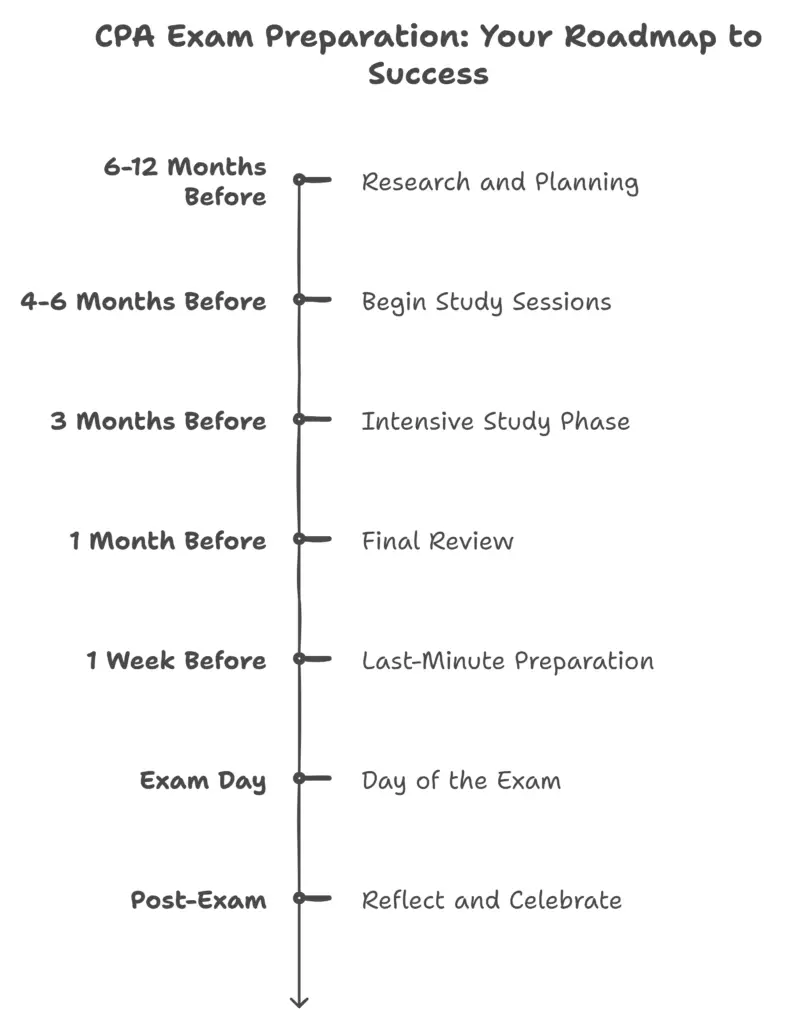

Step 3: Pass the CPA Exam

The CPA Exam is a rigorous test that evaluates your knowledge and skills in accounting. Administered by the American Institute of Certified Public Accountants (AICPA), the exam consists of four sections:

- Auditing and Attestation (AUD)

- Business Environment and Concepts (BEC)

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

Tips for Success:

- Create a Study Plan: Allocate at least 3-6 months for each section.

- Invest in Review Courses: Use popular CPA exam prep platforms like Becker, Roger CPA, or Wiley.

- Take Practice Exams: Familiarize yourself with the exam format and timing.

Test Your Knowledge: Which section of the CPA exam do you think would be the most challenging for you, and why?

Step 4: Fulfill State-Specific Licensing Requirements

Once you pass the CPA Exam, the next step is obtaining your CPA license. Requirements vary by state, but they typically include:

- Ethics Exam: Some states require a separate ethics exam.

- Residency: Verify if your state requires residency to apply for a license.

- Continuing Education: Understand ongoing Continuing Professional Education (CPE) requirements to maintain your license.

Check out our state-by-state CPA licensing guide for detailed requirements.

Step 5: Start Your CPA Career

Congratulations! Once you’re licensed, the possibilities are endless. CPAs can pursue roles such as:

- Public Accountant: Work in auditing, tax, or advisory services.

- Corporate Accountant: Specialize in financial reporting, budgeting, or internal controls.

- Consultant: Provide strategic guidance on mergers, acquisitions, or compliance.

Practical Tip:

Leverage your CPA designation on professional platforms like LinkedIn to attract job opportunities.

Key Takeaways

- Education Is Key: Ensure you meet the 150-credit requirement through strategic course selection.

- Experience Matters: Seek internships and entry-level roles to gain relevant work experience.

- Preparation Pays Off: Invest time and resources in passing the CPA Exam.

- Stay Informed: Understand your state’s licensing requirements to avoid delays.

- Market Yourself: Highlight your CPA credentials to advance your career.

Take the First Step Today

Becoming a CPA is a challenging but rewarding journey. Start by assessing your current qualifications and identifying areas where you need to focus.

Ready to dive deeper? Visit our CPA Resource Hub for study tips, downloadable checklists, and expert insights to guide you every step of the way.